Moving into your first apartment is a big step, and it’s important to be prepared for the financial responsibilities that come with it. While there’s a lot of excitement that comes with the prospect of having your own place, budgeting for your first apartment can be a bit overwhelming. But fear not, it doesn’t have to be a stressful process! By following our simple tips, you can learn how to budget for your first apartment and ensure a smooth transition into your new home. From understanding your income and expenses to finding affordable housing options, this guide will equip you with the tools you need to successfully manage your finances and enjoy the freedom of apartment living.

Calculating Your Monthly Income and Expenses

Before you can create a budget, you need to figure out how much money you have coming in and going out. This means calculating your monthly income and monthly expenses.

To calculate your monthly income, add up all of your sources of income, including your salary, wages, tips, and any other regular income you receive. If you have multiple jobs, be sure to add up your income from all of them.

To calculate your monthly expenses, start by listing out all of your regular expenses. This includes things like rent, utilities, groceries, transportation, and entertainment. Once you have a list of all your expenses, add them up to get your total monthly expenses.

Once you have your monthly income and expenses, you can start to see where your money is going. This information is essential for creating a budget that works for you.

Setting a Realistic Rent Budget

Before you start apartment hunting, it’s important to set a realistic rent budget. This will help you narrow down your search and avoid overspending. A good rule of thumb is to spend no more than 30% of your gross monthly income on rent. This includes utilities, but not any other expenses.

To determine your budget, start by calculating your gross monthly income. This is the amount of money you earn before taxes and other deductions. Then, multiply your gross monthly income by 0.30. This will give you your maximum rent budget. For example, if you earn $3,000 per month, your maximum rent budget would be $900.

Once you have a budget in mind, start researching apartments in your area. You can use online listing sites, contact real estate agents, or drive around neighborhoods to get an idea of what’s available. When comparing apartments, be sure to factor in the cost of utilities and other expenses.

Setting a realistic rent budget is essential for financial stability. By following these tips, you can find an apartment that fits your needs and budget.

Estimating Utility Costs

One of the most important aspects of budgeting for your first apartment is understanding your potential utility costs. These expenses can add up quickly, so it’s essential to factor them into your overall budget.

To get a good estimate, reach out to your prospective landlord or property management company. They can often provide you with average utility costs for the unit. However, your actual bills will depend on your individual usage habits.

Here are some common utilities to consider:

- Electricity: The amount you pay will depend on how much you use appliances, lighting, and heating or cooling systems.

- Gas: This is typically used for heating and cooking, and the cost will vary based on your usage and the climate.

- Water: Your water bill will be influenced by your shower habits, laundry usage, and lawn watering.

- Trash: Many apartments include trash collection in the rent, but if it’s a separate bill, you’ll need to factor it into your budget.

- Internet and Cable: While not strictly utilities, these services can add significant expenses to your monthly budget.

When estimating your utility costs, it’s wise to overestimate a bit to account for fluctuations in usage. You can also research the average utility bills in your area to get a better sense of what to expect.

Factoring in Moving Expenses

Moving into your first apartment is a big step, and it’s important to budget for all the expenses involved. One often-overlooked category is moving expenses. You’ll need to account for everything from hiring movers to buying packing supplies. While some costs are unavoidable, others can be minimized with a little planning.

When budgeting for your move, consider the following:

- Moving truck rental or professional movers: Depending on the distance, the amount of belongings, and your available time, you may choose to rent a truck or hire professional movers. Research prices and consider the pros and cons of each option.

- Packing supplies: Boxes, tape, packing peanuts, bubble wrap, and other packing materials can add up. Consider purchasing these items in bulk or see if you can acquire used boxes from friends, family, or local businesses.

- Fuel and tolls: If you’re driving a moving truck, factor in the cost of gas, tolls, and potential parking fees.

- Moving insurance: It’s wise to purchase moving insurance to protect your belongings in case of damage or loss during the move.

- Unpacking and setup: You may need to purchase basic furniture or supplies for your new apartment, such as a sofa, bedding, or kitchen utensils.

It’s a good idea to set aside a separate budget for moving expenses and add a buffer for unexpected costs. Be sure to factor in these expenses when creating your overall budget for your first apartment.

Creating a Savings Plan for Rent and Deposits

Moving into your first apartment is a big step, and it’s important to be financially prepared. One of the biggest expenses you’ll face is rent and deposits. Here’s how to create a savings plan to cover these costs:

1. Estimate Your Costs:

- First Month’s Rent: This is usually due upfront when you sign your lease.

- Security Deposit: This is typically one or two months’ rent, held by the landlord in case of damages.

- Last Month’s Rent: Some landlords require you to pay the last month’s rent upfront.

- Pet Deposit: If you have pets, you may need to pay a pet deposit.

- Application Fee: This is usually a small fee charged by the landlord to process your application.

2. Set a Savings Goal:

Add up all the estimated costs and set a realistic savings goal. Consider how much you can save each month and how long it will take to reach your goal.

3. Track Your Progress:

Use a budgeting app or spreadsheet to track your savings. Seeing your progress can motivate you to stay on track.

4. Consider Extra Savings:

It’s always a good idea to have a little extra saved for unexpected expenses, such as moving costs or furniture.

5. Get Creative:

If you need to speed up your savings, look for ways to cut expenses or earn extra income. Consider selling unused items, taking on a side hustle, or reducing your spending.

By following these steps, you can create a solid savings plan to help you reach your goal of moving into your first apartment.

Exploring Renters Insurance Options

Renters insurance is an essential component of budgeting for your first apartment. It provides financial protection against unexpected events, such as theft, fire, or water damage. It’s a wise investment that safeguards your belongings and offers peace of mind.

When exploring renters insurance options, it’s crucial to compare different policies and their coverage. Consider factors like personal property coverage, liability coverage, and additional living expenses. Personal property coverage protects your belongings against damage or theft, while liability coverage safeguards you against lawsuits from injuries sustained in your apartment. Additional living expenses help cover temporary housing and other costs if you’re displaced due to an insured event.

Look for policies that offer comprehensive coverage at an affordable price. You can compare quotes from multiple insurers to find the best value. It’s also essential to understand the policy’s deductibles and limitations. Your insurance company might require you to file a claim before reaching a certain deductible amount. Understanding these aspects will help you make informed decisions about your renters insurance.

In addition to basic coverage, consider optional add-ons such as earthquake or flood insurance, depending on your location and risk factors. These add-ons can provide extra protection for your belongings in case of specific disasters. By exploring renters insurance options and choosing the right coverage, you can effectively budget for your first apartment and protect yourself financially.

Considering Furnishing and Decorating Costs

Moving into your first apartment is an exciting time, but it can also be a little overwhelming. You’ll need to budget for everything from rent and utilities to furniture and decor. One of the biggest expenses you’ll face is furnishing and decorating your new space. It’s easy to get carried away with all the possibilities, but it’s important to be realistic about your budget.

Start by making a list of all the essential furniture you need. This could include a bed, a couch, a dining table, and chairs, a coffee table, and a desk. Don’t forget about smaller items like lamps, rugs, and curtains. Once you have a list of everything you need, you can start shopping around for the best deals.

There are a few things you can do to save money on furniture and decor. First, consider buying used furniture. You can find great deals at thrift stores, consignment shops, and online marketplaces. Second, don’t be afraid to DIY. You can paint, reupholster, or refinish furniture to give it a new look. Third, take advantage of sales and coupons. Many retailers offer discounts on furniture and decor throughout the year.

It’s important to set a budget for your furniture and decor and stick to it. Be realistic about what you can afford and don’t overspend. If you need to, you can always gradually furnish and decorate your apartment over time.

Budgeting for Groceries and Household Supplies

Moving into your first apartment is exciting, but it also comes with the responsibility of managing your own finances. One of the biggest expenses you’ll face is budgeting for groceries and household supplies. To help you plan effectively, here are some tips:

Track your spending: For a few weeks, keep a detailed record of your grocery and household spending. Analyze your purchases and identify areas where you can cut back.

Create a grocery list: Before you head to the store, make a comprehensive grocery list. This will help you stick to your budget and avoid impulse buys.

Shop around for deals: Compare prices between different stores and take advantage of discounts, coupons, and loyalty programs. Consider buying in bulk for items you use frequently.

Cook at home: Eating out can quickly drain your budget. Prioritize cooking meals at home, and try out budget-friendly recipes.

Stock up on essentials: Keep a pantry stocked with basic pantry staples like rice, beans, pasta, and canned goods. This will ensure you have a foundation for meals even if you run low on fresh produce.

Set aside a budget for cleaning supplies: Essential cleaning supplies like dish soap, laundry detergent, and disinfectant wipes are necessary for a clean and healthy living space. Allocate a specific budget for these items.

Look for affordable alternatives: Explore generic brands, store-brand items, and bulk buying options to save money on household supplies.

Don’t forget the unexpected: Set aside a small emergency fund to cover unexpected expenses, like a sudden need for a replacement appliance.

By following these tips, you can create a realistic budget for your groceries and household supplies, ensuring you have the resources to manage your new apartment without breaking the bank.

Planning for Transportation and Parking Expenses

Moving into your first apartment is an exciting time, but it’s also important to be realistic about your budget. One often overlooked expense is transportation and parking. If you’re not planning on living within walking distance of your job and daily activities, factor in these expenses. Calculate the average cost of gas and consider car maintenance. If you’re driving an older car, plan for more frequent repair costs. Also, think about public transportation costs if you’ll be using buses, trains, or subways to get around. You might also need to pay for parking at work, at the gym, or for shopping trips. If you’re in a city, parking permits can also be a significant expense. Consider a combination of transportation options like biking or walking to help you save on these costs.

Setting Up a Budget Tracking System

Once you have a good idea of your income and expenses, it’s time to set up a system for tracking your budget. There are many different ways to do this, but the most important thing is to find a system that works for you and that you’ll actually use.

Here are a few popular methods:

- Spreadsheet: This is a simple and free way to track your budget. You can create a spreadsheet in Google Sheets or Microsoft Excel.

- Budgeting Apps: Many budgeting apps are available, such as Mint, YNAB (You Need a Budget), and Personal Capital. These apps can help you track your spending, set budgets, and even help you reach your financial goals.

- Pen and Paper: If you prefer a more hands-on approach, you can use a simple notebook to track your budget. This can be a good way to stay more mindful of your spending.

No matter which method you choose, make sure to track all of your income and expenses. This will help you to see where your money is going and make informed decisions about your spending.

Prioritizing Needs vs. Wants

One of the most crucial steps in creating a budget for your first apartment is distinguishing between your needs and your wants. While it’s tempting to indulge in luxurious amenities and furnishings, it’s vital to focus on the essentials to avoid overspending.

Needs encompass the bare minimum requirements for comfortable living. This includes:

- A safe and secure place to live

- A comfortable bed and bedding

- Basic kitchen appliances (e.g., stove, refrigerator)

- Essentials for personal hygiene and cleaning

- Reliable internet access

Wants, on the other hand, are items that enhance your living experience but aren’t strictly necessary. Examples include:

- A fancy couch or coffee table

- A high-end television or entertainment system

- Decorative items and artwork

- A gym membership or other recreational activities

While it’s okay to have some wants, it’s crucial to prioritize your needs when creating a budget. Start by focusing on the essentials and gradually add in wants as your finances allow. Remember, a solid financial foundation is key to a successful and stress-free apartment experience.

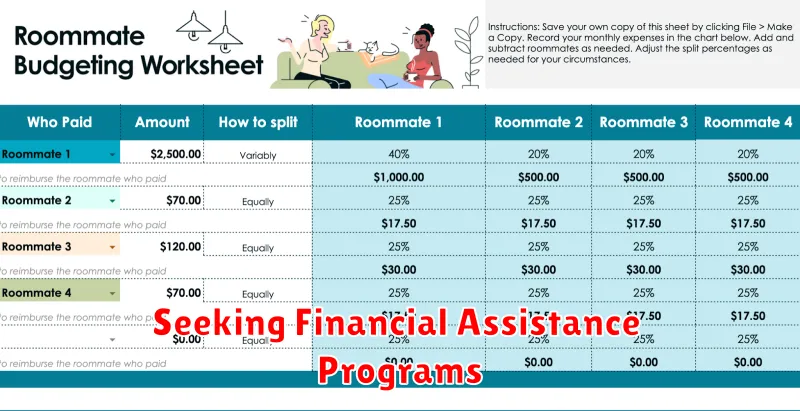

Seeking Financial Assistance Programs

If you’re facing financial constraints, exploring financial assistance programs can be a viable option. Many organizations offer assistance with rent and utilities, particularly for low-income individuals and families.

Look into programs like Section 8 Housing Choice Voucher Program, which provides rental subsidies, or Low-Income Home Energy Assistance Program (LIHEAP), which assists with energy costs.

Additionally, some cities and states offer their own rental assistance programs. Research local government resources and contact social service agencies for information on available options.

Remember to inquire about eligibility requirements and application procedures. Be prepared to provide necessary documentation, such as proof of income and residency.

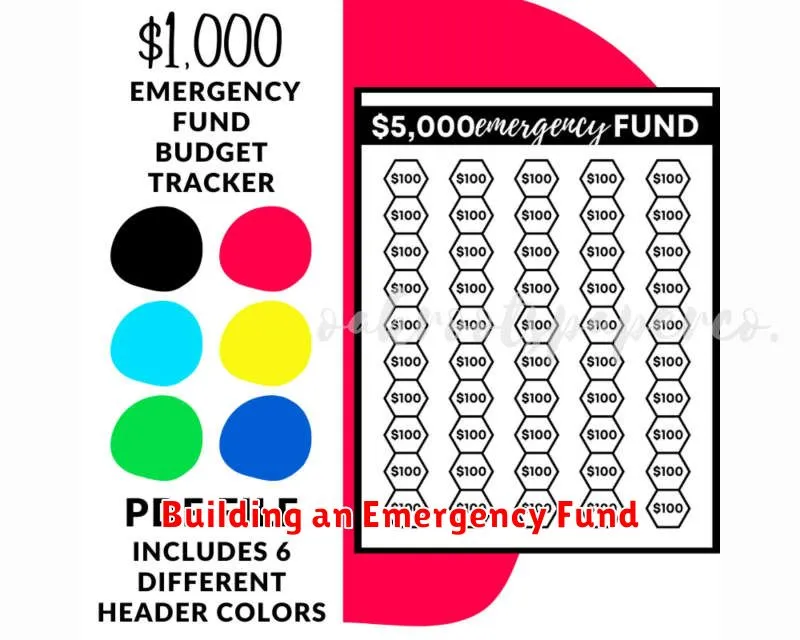

Building an Emergency Fund

Moving into your first apartment is an exciting milestone, but it also comes with new financial responsibilities. One of the most important things you can do is to establish an emergency fund. This is a separate savings account specifically designed to cover unexpected expenses that may arise, such as medical bills, car repairs, or job loss. Aim to save at least three to six months’ worth of living expenses in your emergency fund. This will provide a financial safety net in case of unforeseen circumstances.

To start building your emergency fund, create a realistic budget and identify areas where you can cut back on spending. Consider setting up an automatic transfer from your checking account to your savings account each month, even if it’s just a small amount. Every little bit helps!

Managing Unexpected Expenses

Moving into your first apartment is an exciting time, but it’s also important to be prepared for unexpected expenses. These can pop up at any time, and they can throw off your budget if you’re not ready for them.

Here are a few tips for managing unexpected expenses:

- Build an emergency fund. A good rule of thumb is to have 3-6 months’ worth of living expenses saved up in case of an emergency.

- Set aside money for repairs. Even if your apartment is new, things can break down. It’s a good idea to set aside a little money each month for repairs, so you’re not caught off guard when something needs to be fixed.

- Have a plan for dealing with unexpected medical expenses. Even if you have health insurance, you may still have to pay for some medical expenses out of pocket. Having a plan in place for how you’ll handle these costs can help you avoid going into debt.

- Track your spending. This will help you identify areas where you can cut back if you need to free up some money.

- Be prepared to make sacrifices. If you have to deal with an unexpected expense, you may have to make some sacrifices in other areas of your budget. Be prepared to adjust your spending so you can cover the cost of the unexpected expense.

By taking these steps, you can be better prepared to handle unexpected expenses and avoid financial stress.