Are you tired of throwing money away on rent and dreaming of owning your own home? Rent-to-own might be the perfect solution for you! This unique approach to homeownership allows you to gradually build equity while living in your dream apartment. In this article, we will explore everything you need to know about finding rent-to-own apartment options, including the pros and cons, how to navigate the process, and essential tips for success. Whether you’re a first-time buyer or looking to upgrade your living situation, this guide will equip you with the knowledge to make informed decisions and embark on your journey towards homeownership.

Understanding Rent-to-Own Agreements

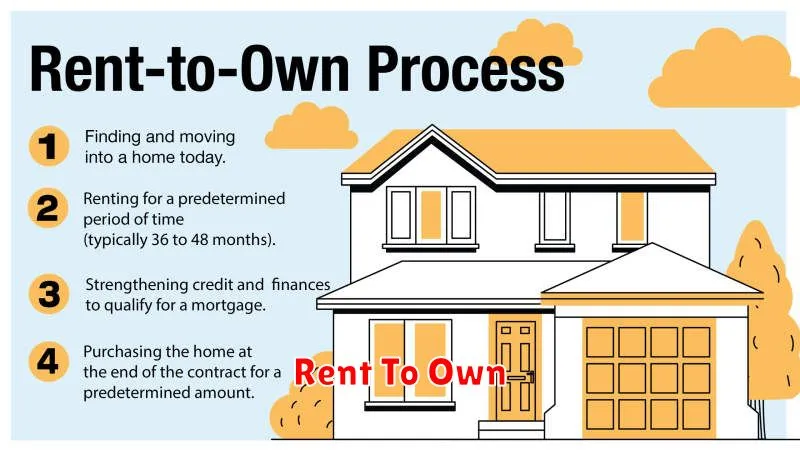

A rent-to-own agreement, also known as a lease-option agreement, is a type of real estate transaction where a tenant pays monthly rent for a property with the option to purchase the property at a predetermined price in the future. It’s a unique blend of renting and buying, offering a potential path to homeownership for those who may not qualify for traditional mortgages immediately.

The agreement typically outlines the following key elements:

- Rent Payments: You’ll make regular rent payments as per the agreement. A portion of these payments may be credited towards the purchase price, which is commonly known as “rent credit” or “option credit”.

- Purchase Price: The agreement specifies a future purchase price, which may be fixed or adjustable. This price will be decided upon during the initial negotiation period.

- Option Period: The agreement stipulates a timeframe within which you have the option to purchase the property. During this period, you’re essentially renting with the right to buy.

- Option Fee: A non-refundable fee, paid upfront, secures your right to purchase the property during the option period. This is usually a significant amount that can be credited towards the purchase price at the end of the option period.

- Closing Costs: At the time of purchase, you’ll be responsible for typical closing costs, like those associated with any traditional mortgage.

Before entering a rent-to-own agreement, consider the following:

- Market Value: Make sure the agreed-upon purchase price reflects the fair market value of the property at the end of the option period.

- Creditworthiness: Your credit score will be evaluated at the end of the option period to determine your eligibility for a mortgage.

- Potential Issues: Be aware of any potential issues that may arise during the option period, such as property damage or unforeseen financial hurdles.

Rent-to-own agreements can be a viable option for some, offering the potential for homeownership with flexibility. However, it’s crucial to understand the terms thoroughly and make an informed decision that aligns with your financial goals and circumstances.

Exploring Different Types of Rent-to-Own Contracts

Rent-to-own contracts offer a unique approach to homeownership, allowing tenants to gradually build equity while living in their desired property. However, it’s essential to understand the different types of contracts available to make an informed decision. Here are some common rent-to-own contract variations:

Lease-Option Agreement: This is the most common type, granting the tenant an option to purchase the property at a predetermined price within a specified timeframe. The tenant pays rent and an option fee, which is often applied toward the purchase price.

Lease-Purchase Agreement: This contract obligates the tenant to purchase the property at the end of the lease term. It typically includes a set purchase price and a predetermined monthly payment that includes rent and a portion of the purchase price.

Land Contract: This agreement is similar to a lease-purchase but involves the seller financing the property directly. The tenant makes payments to the seller, who holds the title until the entire purchase price is paid.

Rent-to-Own with Equity Buildup: This option involves a portion of the rent being applied toward the future purchase price, helping the tenant build equity over time.

Each contract type has its own advantages and disadvantages, so it’s crucial to carefully review the terms and conditions before signing. Consult with a real estate professional to determine which option best suits your financial situation and goals.

Researching Rent-to-Own Opportunities in Your Area

Once you’ve decided that a rent-to-own option is right for you, it’s time to start researching what’s available in your area. There are a few different ways to do this:

Online search: Several websites and apps specialize in connecting renters with rent-to-own properties. These platforms allow you to filter your search by location, price, and other criteria. Some popular options include:

- Rent.com

- Rentometer

- Zillow

- Apartments.com

Local real estate agents: Real estate agents often have access to listings that aren’t publicly advertised. They can also provide valuable insights into the local market and help you negotiate a good deal. If you’re unsure about a property’s suitability, a real estate agent can also offer advice.

Network with friends and family: Sometimes the best deals are found through word-of-mouth. Ask your friends and family if they know of any rent-to-own properties in your area. They may have heard about something that hasn’t been advertised yet.

Contact property managers directly: Many property management companies offer rent-to-own options. You can find their contact information online or in local newspapers. Don’t hesitate to reach out and inquire about their availability and terms.

Working with Real Estate Agents Specializing in Rent-to-Own

When seeking a rent-to-own apartment, enlisting the help of a real estate agent specializing in this niche can greatly benefit your search. These agents possess extensive knowledge and experience within the rent-to-own market, making them invaluable resources throughout your journey.

By working with a specialized agent, you gain access to a network of rent-to-own properties that might not be readily available on public listings. They can guide you through the complexities of rent-to-own contracts, negotiating terms, and understanding your financial obligations.

Furthermore, a skilled rent-to-own agent can provide valuable insights into the local market, assisting you in identifying properties that align with your needs and budget. They can also help you navigate the process of qualifying for rent-to-own opportunities, ensuring a smooth and successful experience.

Connecting with Property Owners Directly

Reaching out to property owners directly can be an effective way to find rent-to-own opportunities. This approach offers several advantages, including:

- Increased Flexibility: You can negotiate terms specific to your needs and circumstances.

- Direct Communication: You have the opportunity to build a relationship with the owner, fostering trust and understanding.

- Greater Transparency: You can inquire about the property’s condition and any potential issues openly.

To connect with property owners, consider these strategies:

- Direct Mailers: Target neighborhoods where you’d like to live and send personalized letters introducing yourself and your rent-to-own aspirations.

- Local Real Estate Agents: Network with real estate professionals who specialize in rentals or property management, as they often have connections with owners.

- Online Platforms: Utilize online forums, social media groups, and neighborhood websites to connect with potential landlords.

- Attend Open Houses: While open houses typically focus on sales, you can express your interest in rent-to-own options to the listing agent or the property owner.

Remember to be polite, professional, and transparent about your intentions when contacting property owners. Clearly articulate your desire for a rent-to-own arrangement and highlight your responsible financial history and commitment to homeownership.

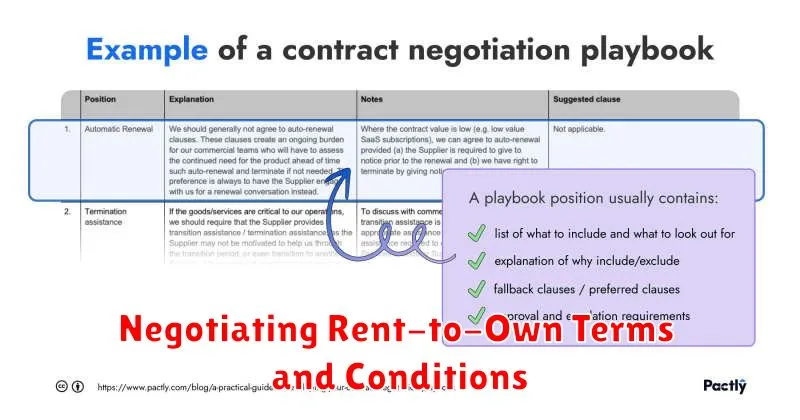

Negotiating Rent-to-Own Terms and Conditions

Once you’ve found a rent-to-own apartment that fits your needs and budget, it’s time to negotiate the terms and conditions of the agreement. This is an important step, as it will determine how much you’ll pay for the property and how long you’ll have to rent before you can purchase it. Be sure to take your time and carefully review the terms of the agreement with your real estate agent or lawyer.

Here are some key points to negotiate:

- Purchase price: This is the price you’ll pay for the property when you purchase it at the end of the lease term. Try to negotiate a purchase price that’s below market value.

- Lease term: This is the length of time you’ll have to rent the property before you can purchase it. The longer the lease term, the more time you’ll have to save up for the purchase price.

- Rent payments: Be sure to understand how much your monthly rent payments will be and whether they will be applied towards the purchase price. You may be able to negotiate a lower rent payment or have a portion of your rent payments applied towards the purchase price.

- Option fee: This is a non-refundable fee you’ll pay to the landlord for the option to purchase the property. Try to negotiate a lower option fee.

- Conditions of purchase: Make sure you understand the conditions you’ll need to meet in order to purchase the property, such as maintaining the property, obtaining financing, and making timely payments.

It’s also important to be aware of any potential downsides to rent-to-own arrangements. For example, some rent-to-own arrangements may not be as advantageous to the renter as they seem, and there’s always the risk that the property will not be appraised at the agreed-upon purchase price, leaving you with a property that is not worth the price you are paying. Therefore, make sure to do your research, understand the terms of the agreement, and get professional advice from a real estate agent or lawyer before entering into a rent-to-own agreement.

Evaluating the Financial Implications of Rent-to-Own

Rent-to-own agreements can be a tempting option for those looking to buy a home, but it’s essential to carefully consider the financial implications before committing. While it might seem like a way to avoid a large down payment upfront, the potential downsides can outweigh the benefits for some.

One major concern is the option fee. This fee is typically paid upfront and is non-refundable, meaning you lose this money if you decide not to purchase the property. The option fee can range from a few thousand dollars to a significant percentage of the purchase price, so it’s crucial to understand the financial commitment you’re making.

Another factor to consider is the rent-to-own payment structure. You’ll usually be paying higher monthly payments than a traditional rental agreement, as a portion of your payments will go towards the eventual purchase price. However, these higher payments may not be reflected in the final purchase price, meaning you could end up paying more than the market value for the property.

Furthermore, rent-to-own agreements often have a “balloon payment” at the end of the lease term. This means that you’ll need to come up with a large sum of money to finalize the purchase, which could be challenging if your financial situation changes in the meantime.

Before entering a rent-to-own agreement, it’s essential to thoroughly research the market value of the property and compare it to the eventual purchase price you’ll be paying. You should also consult with a financial advisor to understand the full financial impact of the agreement and ensure it aligns with your overall financial goals.

While rent-to-own can be a viable option for some, it’s important to weigh the potential risks and benefits carefully. By understanding the financial implications and making informed decisions, you can make a choice that best suits your individual circumstances and financial goals.

Understanding the Legal Aspects of Rent-to-Own Agreements

Rent-to-own agreements, also known as lease-purchase agreements, can be a good option for people who want to eventually own a home but may not be ready to buy right away. These agreements allow you to rent a property for a set period of time with the option to purchase it at the end of the lease. However, it’s important to understand the legal aspects of these agreements before you sign one.

One of the most important things to consider is the purchase price. The agreement should clearly state the price you will pay for the property when you exercise your option to buy. It’s also important to understand how the rent payments will be applied to the purchase price. In some cases, a portion of your rent payments may be credited toward the purchase price, while in other cases, your rent payments will be considered separate from the purchase price.

Another important factor to consider is the lease term. The lease term should be long enough for you to save up for the down payment and close on the property. It’s also important to understand the conditions for terminating the lease. Some rent-to-own agreements allow you to terminate the lease early, while others may require you to pay a penalty if you break the agreement.

It’s essential to have a lawyer review the agreement before you sign it. This is especially important if the agreement contains any unusual or unclear terms. A lawyer can help you understand your rights and obligations under the agreement and ensure that the terms are fair and reasonable.

By understanding the legal aspects of rent-to-own agreements, you can make an informed decision about whether this option is right for you.

Seeking Professional Advice from a Real Estate Attorney or Financial Advisor

Before you commit to a rent-to-own agreement, it’s crucial to seek professional advice from a real estate attorney or a financial advisor. This step ensures that you understand the terms and conditions of the agreement, as well as your rights and responsibilities. A real estate attorney can review the contract and ensure that it’s legally sound and doesn’t contain any unfair clauses. They can also advise you on your legal options if something goes wrong.

A financial advisor can help you assess your finances and determine if a rent-to-own arrangement is financially feasible for you. They can also help you create a budget that accounts for all the associated costs, including rent payments, option fees, and potential future mortgage payments.

By seeking professional advice, you can ensure that you’re making an informed decision and protecting yourself financially. It’s a wise investment that can save you from potential legal and financial issues down the road.

Making an Informed Decision about Rent-to-Own

While rent-to-own options can seem like a great way to build equity and eventually own a home, it’s crucial to understand the potential risks and benefits before making a decision.

Pros:

- Builds equity: A portion of your rent payments goes toward the eventual purchase of the property.

- Credit building: On-time rent payments can positively impact your credit score.

- Avoids traditional mortgage requirements: Rent-to-own agreements often have less stringent qualification requirements compared to traditional mortgages.

Cons:

- Higher overall cost: Rent-to-own programs typically come with higher monthly payments and potentially non-refundable option fees.

- Limited flexibility: You may be locked into the property for a set period, limiting your ability to move.

- Risk of losing investment: If you’re unable to purchase the property at the end of the lease, you might lose the money you’ve paid towards the option.

- Potential for hidden costs: Ensure the agreement clearly outlines all fees, repairs, and maintenance responsibilities.

Before making a decision, it’s vital to:

- Compare options: Look at traditional mortgage financing to see if it’s a more affordable option.

- Read the contract carefully: Understand the terms, including purchase price, option fees, and any contingencies.

- Seek professional advice: Consult with a real estate agent or financial advisor to assess your financial situation and the suitability of a rent-to-own agreement.

Ultimately, rent-to-own can be a viable path to homeownership, but it’s essential to make an informed decision after carefully weighing the pros and cons and understanding the potential risks involved.