Are you about to rent a new place? If so, you’ll likely be asked to pay a security deposit. A security deposit is a sum of money that a tenant pays to a landlord to protect the property from damage. If the tenant leaves the property in good condition, the deposit is typically returned to the tenant at the end of the lease. However, if there is damage, the landlord may use the security deposit to pay for repairs. This article will discuss everything you need to know about security deposits, including how they work, what they cover, and how to avoid losing your deposit.

Understanding Security Deposits: Purpose and Legalities

A security deposit is a sum of money a tenant pays to a landlord at the start of a lease. It’s held as a safeguard against potential damages to the property or unpaid rent. Landlords use it to cover costs associated with repairs, cleaning, or outstanding bills after the tenant moves out.

The legal framework surrounding security deposits varies by state and jurisdiction. It’s essential to consult your local laws to understand the specific regulations governing:

- Maximum deposit amount: Most states have limits on how much a landlord can charge for a security deposit.

- Deposit return timeline: The timeframe for returning the deposit after the tenant moves out is typically defined.

- Deduction procedures: The landlord must have a legitimate reason to deduct from the deposit, and often needs to provide documentation supporting any deductions.

- Interest accrual: Some states require landlords to pay interest on security deposits.

It’s crucial to document everything related to the security deposit, including the amount paid, the date of payment, and any deductions made. Landlords should provide tenants with a detailed itemized list of deductions if any are made. Tenants should keep copies of all relevant documentation for their records.

State Laws Governing Security Deposits: Limits and Regulations

Each state has its own laws governing security deposits, including limits on the amount landlords can charge and regulations on how the money must be handled. It’s crucial for both landlords and tenants to understand these rules to avoid potential legal issues.

Limits on Security Deposit Amounts: Many states have laws limiting the amount of security deposit a landlord can charge. These limits typically vary depending on the type of rental property (e.g., apartment, house, condo) and the location within the state. Some states may also allow landlords to charge additional deposits for pets or other specific circumstances.

Regulations on Handling Security Deposits: State laws also dictate how landlords must handle security deposits. This includes requirements for:

- Depositing the funds: Landlords must deposit security deposits into a separate escrow account, typically in a bank or other financial institution. This ensures the money is protected and readily available when needed.

- Providing written documentation: Landlords must provide tenants with written documentation detailing the security deposit amount, the terms of its use, and the process for its return. This documentation should include the account where the deposit is held.

- Returning the deposit: Upon termination of the lease, landlords are obligated to return the security deposit to the tenant, less any deductions for damages beyond normal wear and tear. Landlords must provide the tenant with an itemized list of deductions, explaining the reason for each.

- Interest payments: Some states require landlords to pay interest on security deposits if the amount held exceeds a certain threshold. This interest is typically paid to the tenant at the end of the lease or when the deposit is returned.

Failure to comply with state laws regarding security deposits can result in legal consequences for landlords, including fines, penalties, and even lawsuits. Tenants, on the other hand, should be aware of their rights and ensure landlords are adhering to the regulations. Understanding these state laws will help both landlords and tenants manage security deposits effectively and avoid potential disputes.

Paying the Security Deposit: Methods and Documentation

Once you’ve agreed to rent a property, the landlord will likely request a security deposit. This deposit is typically a refundable amount that covers potential damages to the property or unpaid rent. It’s important to understand the methods for paying your security deposit and the documentation you should keep for your records.

Methods of Payment:

- Cash: While some landlords accept cash, it’s generally discouraged due to the risk of loss or theft. If you do pay cash, be sure to get a receipt.

- Check: A personal check is a common way to pay a security deposit. Make the check out to the landlord’s name and write “Security Deposit” in the memo line.

- Money Order: Similar to a check, a money order provides a secure way to pay. Obtain a money order from a post office or financial institution.

- Online Payment: Some landlords offer online payment options through their website or a third-party platform. This can be convenient but make sure the platform is secure and reliable.

Documentation:

It’s crucial to keep a record of your security deposit payment. This documentation will be essential if you ever need to dispute a deduction from your deposit or reclaim it at the end of your lease.

- Receipt: Obtain a receipt for any payment you make, whether it’s cash, check, or money order. This should clearly state the date, amount, and purpose of the payment.

- Lease Agreement: Your lease agreement should detail the amount of the security deposit, the payment method, and the terms for its return.

- Move-In Condition Report: This document outlines the existing condition of the property, including any pre-existing damages. It’s important to complete this form with your landlord and keep a copy for your records.

Non-Refundable Fees vs. Security Deposits: Knowing the Difference

When renting a property, you might encounter terms like “security deposit” and “non-refundable fee.” These might sound similar, but they serve different purposes and have varying implications for your finances. Understanding the difference between these two is crucial for making informed decisions as a renter.

Security deposits are funds held by the landlord to cover potential damages to the property beyond normal wear and tear. They are typically refundable to tenants upon moving out if the unit is returned in good condition, minus any deductions for repairs.

Non-refundable fees, on the other hand, are payments that are not returned to the tenant, regardless of the condition of the property. These fees might cover things like application processing, credit checks, or administrative costs. It is crucial to carefully review your lease agreement to understand the specific purpose of any non-refundable fees.

While both security deposits and non-refundable fees are payments you make upfront, it’s important to understand that a security deposit is intended to protect the landlord, while a non-refundable fee is revenue for the landlord. This distinction can be crucial, especially when you’re budgeting for moving expenses or considering the overall cost of renting a property.

Walkthrough Inspections: Documenting the Condition of the Apartment

A walkthrough inspection is a crucial part of the rental process, both when you move in and move out. It’s a time to document the condition of the apartment, ensuring that you and your landlord are on the same page regarding any existing wear and tear. This documentation will be essential when it comes to getting your security deposit back.

When moving in, schedule a walkthrough with your landlord before you start unpacking. Take photos or videos of any pre-existing damage, such as scratches on the walls, stains on the carpet, or a broken appliance. Make sure the landlord signs a document that confirms these issues are not your responsibility. This will prevent them from trying to deduct these damages from your security deposit when you move out.

When moving out, another walkthrough is necessary. Thoroughly clean your apartment and ensure it’s in the same condition as when you moved in, minus normal wear and tear. If possible, have your landlord present during the cleaning process so you can point out any areas that require attention. If you have photos or videos from the initial walkthrough, use them as a reference point to ensure there are no surprises when it comes to getting your security deposit back.

It’s important to keep a detailed record of both walkthroughs. This record should include dates, times, photos, videos, and any written agreements with your landlord. This documentation will serve as proof of the condition of the apartment and will be crucial when negotiating the return of your security deposit.

By understanding and actively participating in walkthrough inspections, you can significantly increase your chances of getting your security deposit back in full.

Maintenance and Repairs: Responsibilities and Deductions

Landlords are responsible for providing a safe and habitable dwelling for their tenants. This includes maintaining the property’s essential systems and appliances, such as plumbing, heating, electrical, and air conditioning. However, tenants also have responsibilities when it comes to maintaining the property.

Tenants are generally responsible for the day-to-day maintenance of the unit, such as cleaning and minor repairs. Landlords can deduct from the security deposit for damages that are the tenant’s responsibility, such as:

- Damage caused by negligence or misuse

- Damage caused by pets

- Excessive wear and tear beyond normal use

It’s crucial to understand what constitutes normal wear and tear versus damage. For example, replacing a light bulb is considered normal wear and tear, but replacing a broken window due to negligence is not.

To avoid unexpected deductions from your security deposit, it’s important to:

- Report any needed repairs to the landlord promptly.

- Take good care of the property.

- Document any existing damages when you move in.

- Keep a record of all communication with your landlord about repairs.

When you move out, you should request a walk-through inspection with your landlord to assess the condition of the property. If there are any deductions from your security deposit, you should be provided with detailed documentation.

It’s important to note that state laws vary regarding landlord responsibilities and tenant rights. It’s always advisable to consult your local tenant laws for specific information.

Damage vs. Normal Wear and Tear: Understanding the Distinction

It’s important to understand the difference between damage and normal wear and tear when it comes to security deposits. This distinction can affect whether you get your security deposit back at the end of your lease.

Normal wear and tear refers to the gradual deterioration of a property that occurs due to ordinary use. This includes things like faded paint, minor scratches on floors, and worn-out carpet. Landlords are generally expected to cover the cost of normal wear and tear as part of maintaining the property.

Damage, on the other hand, refers to any significant deterioration or damage to a property that is beyond normal wear and tear. Examples of damage include broken windows, holes in the walls, or damaged appliances. Tenants are typically responsible for paying for damage to the property, and landlords can deduct the cost of repairs from the security deposit.

It’s important to note that what constitutes normal wear and tear can vary depending on the age of the property, the type of unit, and the specific terms of the lease agreement. It’s always a good idea to take photos of the property before you move in and again when you move out to document the condition of the property.

If you’re unsure whether something is considered damage or normal wear and tear, it’s best to communicate with your landlord. They can help you understand their expectations and can guide you on how to properly care for the property.

Getting Your Security Deposit Back: Procedures and Timeframes

Getting your security deposit back after moving out is often a stressful process. However, understanding the procedures and timelines can help make the process smoother. It is important to remember that every state has different laws regarding security deposits, so it’s essential to familiarize yourself with the specific laws in your location.

Here are the general steps involved in getting your security deposit back:

- Provide a forwarding address: Notify your landlord of your new address in writing. This will ensure that they can easily contact you if necessary.

- Perform a move-out inspection: Before leaving the property, schedule a final walk-through with your landlord. Document any existing damage or wear and tear. Take pictures or videos as evidence.

- Submit a cleaning and damage report: Following the inspection, submit a formal report to your landlord detailing the condition of the property. This can help prevent any unnecessary deductions from your deposit.

- Request your security deposit refund: Once you have vacated the property, submit a written request for your security deposit refund. Include your contact information and details on the final inspection report. The request can be made by mail, email, or in person.

Timeframes for receiving your deposit back vary by state. Some states require landlords to return the deposit within a specific timeframe, while others allow them a longer period. Always refer to your lease agreement or your state’s landlord-tenant laws for specific information.

If your landlord fails to return your deposit within the designated timeframe or unjustly deducts any amount, you may be able to take legal action. Consult with a local attorney specializing in landlord-tenant law to understand your rights and options.

By following these steps and understanding your state’s laws, you can increase your chances of getting your security deposit back promptly and without any unnecessary deductions.

Disputing Deductions: Legal Options and Procedures

If you believe that your landlord has unfairly deducted from your security deposit, you have several options available to you. Understanding your rights and the legal procedures involved is crucial in disputing these deductions.

Firstly, it is essential to review your lease agreement. Your lease should outline the specific reasons for which your landlord can deduct from your security deposit. This might include damages beyond normal wear and tear, unpaid rent, or violations of lease terms. It’s crucial to have a strong understanding of your lease terms to determine whether the deductions are justified.

If you believe the deductions are unreasonable, initiate a formal dispute process. This usually involves sending a written letter or email to your landlord detailing the reasons for your disagreement. Be sure to include clear evidence, such as photos or receipts, to support your case. Depending on the state’s laws, you might also need to file a formal dispute with a local housing authority or small claims court.

When approaching a dispute, it’s essential to consider the potential legal costs associated with seeking legal representation. If your claim is straightforward and the amount in dispute is small, you may be able to handle the dispute yourself. However, if the deductions are substantial or you’re facing complex legal arguments, seeking legal advice from a qualified attorney is recommended.

Remember that navigating the legal landscape of security deposits can be complex. It’s essential to understand your rights, stay organized, and keep detailed records of all communication and evidence. Taking these steps can significantly increase your chances of successfully disputing unreasonable deductions and securing a fair resolution.

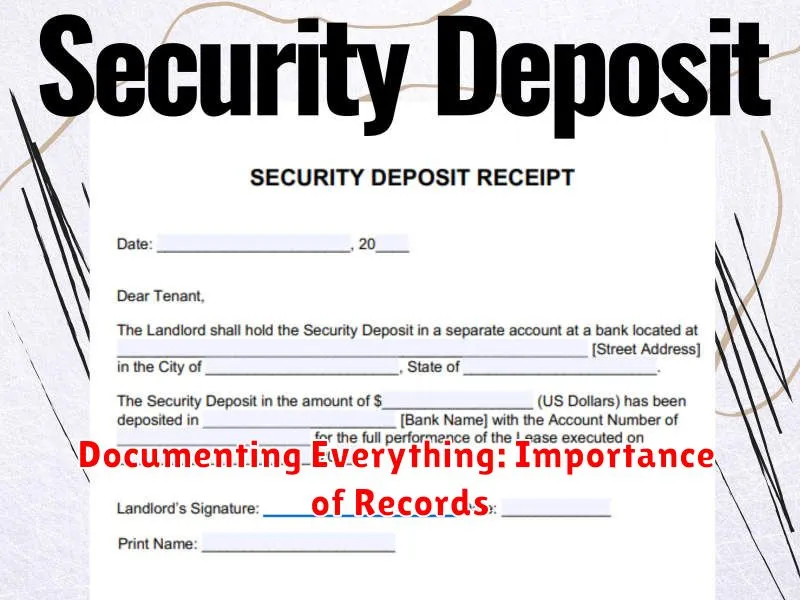

Documenting Everything: Importance of Records

When it comes to security deposits, proper documentation is essential. Keeping accurate records serves as a crucial element in safeguarding your interests as both a landlord and a tenant.

As a landlord, meticulously documenting everything is paramount for several reasons. Firstly, it provides concrete evidence in case of disputes regarding the security deposit. If a tenant claims you’ve wrongfully withheld their deposit, having detailed records can be your saving grace, proving that the deductions made were justified.

Furthermore, maintaining accurate records helps you stay organized. Knowing the exact amount of security deposits received, deductions made, and the remaining balance ensures transparency and clarity in your financial transactions.

For tenants, detailed documentation empowers you to hold your landlord accountable. Should a dispute arise over the security deposit, having documentation of the property’s condition at the beginning of your lease can be beneficial.

In essence, whether you’re a landlord or a tenant, documenting everything ensures a clear and transparent process regarding security deposits. It safeguards your interests, promotes accountability, and facilitates a smooth and amicable conclusion.

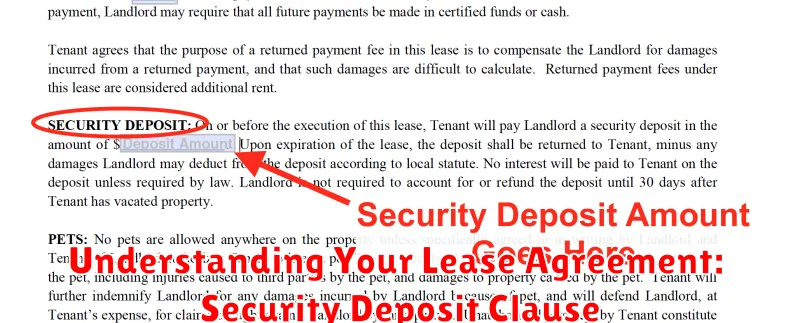

Understanding Your Lease Agreement: Security Deposit Clause

The security deposit clause in your lease agreement is a crucial section that outlines the terms and conditions related to your security deposit. It specifies the amount of the security deposit, the purpose of the deposit, and the conditions under which it can be used by the landlord. Understanding this clause is essential for both landlords and tenants to ensure a smooth and transparent relationship.

The primary purpose of a security deposit is to protect the landlord from financial losses due to damages or unpaid rent by the tenant. The deposit is typically held in a separate account and can be used to cover costs such as:

- Unpaid rent: If a tenant fails to pay rent, the landlord can use the security deposit to cover the outstanding amount.

- Damages beyond normal wear and tear: If a tenant causes damage to the property beyond reasonable wear and tear, the landlord can use the security deposit for repairs.

- Cleaning costs: If the property is left in an excessively dirty state, the landlord may use the deposit for cleaning costs.

The security deposit clause should clearly state:

- The amount of the deposit: This is usually a fixed amount, determined by the landlord and outlined in the lease agreement.

- The purpose of the deposit: The lease should clearly outline the specific reasons for which the landlord can use the security deposit.

- The conditions under which the deposit can be used: This clarifies the specific circumstances under which the landlord can use the deposit, for example, unpaid rent or damages exceeding normal wear and tear.

- The process for returning the deposit: The lease agreement should outline the process for returning the deposit to the tenant upon termination of the lease. This may involve submitting a written request and providing proof of payment.

- The time frame for returning the deposit: The lease should state the time frame within which the landlord is obligated to return the deposit, which typically varies depending on the state laws.

It’s crucial to carefully review and understand the security deposit clause in your lease agreement. If you have any questions or concerns, don’t hesitate to discuss them with your landlord or a legal professional.

Moving Out Procedures: Inspection and Key Return

Moving out of a rental property can be stressful, especially when it comes to security deposits. Understanding the moving out procedures, particularly the inspection and key return process, is crucial to ensure a smooth transition and prevent any potential issues with your deposit.

Most rental agreements outline specific moving out procedures, including a timeframe for notifying the landlord of your intention to vacate and scheduling a move-out inspection. During this inspection, the landlord or their representative will assess the condition of the property, comparing it to the original condition when you moved in. It’s essential to be present during the inspection and document any pre-existing damages or repairs that were not your fault.

Once the inspection is completed, you will be required to return the keys to the landlord. This should be done according to the agreed-upon process outlined in your lease agreement. Ensure you obtain a receipt confirming the key return. This receipt serves as evidence that you fulfilled your obligation to return the property in good condition.

Following the inspection and key return, the landlord will typically have a set time frame to assess the condition of the property and determine any deductions from your security deposit. Be sure to keep a record of all communications with the landlord, including inspection reports and any deductions made from your security deposit. If you disagree with any deductions, you have the right to challenge them.

Communicating with Your Landlord: Addressing Concerns

Open and clear communication with your landlord is essential, especially when it comes to your security deposit. If you have any concerns or questions about your deposit, don’t hesitate to reach out to your landlord.

To ensure effective communication, consider the following tips:

- Be polite and respectful. Approach the conversation with a positive attitude.

- Be specific. Clearly state your concern and provide details to support your request.

- Document everything. Keep records of all communication, including dates, times, and the content of the conversation.

- Maintain a professional tone. Avoid using accusatory language or making personal attacks.

- Seek clarification. If you are unsure about any aspect of the security deposit agreement, ask for clarification.

By following these tips, you can foster a positive and productive relationship with your landlord, which can ultimately help you secure your rightful refund.