Moving into a new apartment is an exciting time, but the application process can be daunting. One of the most important aspects of the application is the background check and credit check. These checks are designed to ensure that you’re a reliable tenant and that you can afford to pay rent. This guide will walk you through what to expect during these checks, how to prepare for them, and what you can do if something is incorrect. Understanding the background check and credit check process can help you avoid surprises and increase your chances of getting approved for your dream apartment.

What Landlords Look for in a Background Check

Landlords conduct background checks to ensure that you’re a responsible and reliable tenant. They want to make sure you’ll pay your rent on time, take care of the property, and be a good neighbor. They’re looking for any red flags that might indicate you’re a risky tenant. Here’s what landlords typically look for in a background check:

Rental History: Landlords want to see a history of consistent rent payments and a positive track record with previous landlords. This shows them that you’re financially responsible and reliable. They’ll be looking for any evictions, unpaid rent, or other negative marks on your record.

Credit History: Your credit history can be a strong indicator of your financial responsibility. Landlords use this information to assess your likelihood of paying rent on time and making other financial commitments. A good credit score is a major plus.

Criminal History: While landlords aren’t always allowed to discriminate based on criminal history, they may use this information to assess potential risks to their property and other tenants. They’re looking for any serious offenses that could raise concerns about your reliability or safety.

Employment Verification: Landlords want to make sure you have a stable source of income to afford rent. This can include verifying your current employment status, salary, and length of employment.

References: Landlords may contact your personal or professional references to get a better understanding of your character and reliability. This can help them gain additional insight into your rental history and overall suitability as a tenant.

It’s important to be aware that landlords may have specific criteria for what they consider acceptable in a background check. By understanding what landlords are looking for, you can take steps to prepare for your background check and increase your chances of getting approved.

Understanding Credit Checks for Apartments

A credit check is a standard part of the apartment application process. Landlords use this information to assess your financial responsibility and determine if you are likely to pay rent on time.

During a credit check, a landlord will look at your credit score, which is a numerical representation of your creditworthiness. Your credit score is based on your credit history, which includes factors such as:

- Payment history: How consistently you’ve paid your bills on time.

- Amounts owed: How much debt you have outstanding.

- Length of credit history: How long you’ve been using credit.

- New credit: How often you apply for new credit.

- Credit mix: The types of credit you have (e.g., credit cards, loans).

A good credit score is typically above 670. Landlords may have their own minimum credit score requirements. If your credit score is lower, you may be asked to provide a co-signer, who agrees to be financially responsible for you if you fail to pay rent.

It is important to note that landlords cannot use credit checks to discriminate against you based on your race, religion, national origin, or other protected characteristics. If you believe that you have been discriminated against, you should contact the Fair Housing Commission.

How to Improve Your Chances of Approval

It’s important to understand that landlords use background checks and credit checks to assess your reliability and trustworthiness as a potential tenant. While you cannot change your past, you can take steps to improve your chances of getting approved for an apartment:

1. Pay Your Bills On Time: Late payments can negatively impact your credit score. Make sure you consistently pay all bills, including rent, utilities, and credit cards, on time.

2. Build Good Credit: Aim for a credit score above 670, which is generally considered good. Pay down existing debt, use credit responsibly, and avoid opening too many new accounts.

3. Be Transparent: Be honest with your landlord about any past credit issues or evictions. Explaining your situation and showing you’ve taken steps to improve can demonstrate responsibility.

4. Provide Proof of Income: Be prepared to show your landlord proof of sufficient income to cover rent. This could include pay stubs, bank statements, or a letter of employment.

5. Offer a Security Deposit: A larger security deposit can show your commitment and make you a more appealing tenant. It can also compensate for a lower credit score or other concerns.

6. Be a Good Tenant: If you have a positive rental history, provide references from previous landlords. This can demonstrate your reliability and responsible tenant behavior.

7. Be Prepared to Answer Questions: Be prepared to answer any questions your landlord may have during the application process. Honesty and transparency can build trust and increase your chances of approval.

By taking these steps, you can increase your chances of passing a background check and credit check, making you a more desirable tenant in the eyes of potential landlords.

Disputing Errors on Your Background Check

It’s important to remember that background checks are not always perfect, and mistakes can happen. If you discover any inaccuracies on your background check report, you have the right to dispute them. The first step is to contact the background check company directly and provide them with documentation to support your claim. This might include copies of court records, police reports, or other relevant documents.

The Fair Credit Reporting Act (FCRA) provides you with specific rights when it comes to background checks. This law requires background check companies to investigate any disputed information and provide you with a written summary of the results. If the company determines that the information is inaccurate, they must correct it in your file.

It’s important to act quickly if you discover any errors on your background check. The longer you wait, the harder it may be to resolve the issue. You can also file a complaint with the Consumer Financial Protection Bureau (CFPB) if you’re unable to resolve the issue with the background check company directly. Remember, by taking the necessary steps to dispute any errors, you can protect your rights and ensure that your background check is accurate and fair.

Common Reasons for Rental Application Rejection

While landlords use background and credit checks to determine your suitability as a tenant, there are several reasons why your application might be rejected. Understanding these reasons can help you improve your chances of getting approved in the future. Here are some common factors that landlords consider:

Credit Score: A low credit score can be a major red flag for landlords. This suggests you might be a financial risk, making it more likely they’ll reject your application.

Rental History: A history of late rent payments, evictions, or property damage can significantly harm your chances. Landlords want tenants who pay rent on time and take good care of the property.

Criminal Background: Certain criminal convictions, especially those related to violence, theft, or drug offenses, may lead to rejection. However, landlords can’t discriminate solely based on race, religion, or disability.

Income Verification: Landlords often require proof of income to ensure you can afford rent. If your income doesn’t meet their requirements, they may decline your application.

References: Negative references from previous landlords can raise concerns about your reliability as a tenant. Be sure to provide positive references and be prepared to explain any negative feedback.

Application Errors: Even minor mistakes on your application, such as incomplete information or inaccuracies, can make a bad impression. Double-check your application carefully before submitting it.

Too Many Applicants: Sometimes, landlords receive many strong applications for a single rental property. If you don’t meet all their criteria perfectly, you may be passed over in favor of other applicants.

Knowing these reasons can help you improve your rental application and increase your chances of getting approved. If your application is rejected, ask for feedback to understand the specific reasons and take steps to address them for future applications.

Rights and Responsibilities as a Tenant

It is essential for tenants to understand their rights and responsibilities to ensure a smooth and harmonious living experience. While landlords are obligated to provide a safe and habitable dwelling, tenants are expected to fulfill certain obligations in return.

One of the most important tenant rights is the right to privacy. Landlords generally cannot enter a tenant’s unit without prior notice, except in emergencies or for routine maintenance. Tenants also have the right to withhold rent if the landlord fails to make necessary repairs or address safety concerns.

However, tenants also have responsibilities, such as paying rent on time, maintaining the premises in a clean and habitable condition, and adhering to the lease agreement. Failing to meet these obligations can lead to legal action and potentially eviction.

Tenants should carefully review their lease agreement and understand the specific terms and conditions. It is recommended to communicate any concerns or issues with the landlord in a timely and professional manner. Open and transparent communication can help prevent misunderstandings and disputes.

By understanding their rights and responsibilities, tenants can navigate the landlord-tenant relationship with confidence and ensure a positive living experience.

Preparing for the Background and Credit Check Process

Before you start looking for a new apartment, you should know that most landlords will perform a background check and credit check on you. These checks help landlords assess your reliability as a tenant, looking at your financial history, criminal record, and rental history.

To prepare for this process, you should:

- Check your credit report: Your credit report is a key factor in the background check process. Request a free copy from the three major credit reporting agencies (Equifax, Experian, and TransUnion) and review it for any errors or outdated information. You can also dispute any inaccuracies you find.

- Organize your rental history: Landlords often check your rental history to verify your payment record and any past issues. Collect contact information and addresses for your previous landlords, including dates of residency and reason for leaving.

- Be transparent about your background: If you have a criminal record, it’s best to be upfront with potential landlords. They may have policies regarding past convictions. However, being open and honest about your situation can make the process more straightforward.

By taking these steps, you can prepare for the background and credit check process and increase your chances of being approved for your dream apartment.

Knowing Your Rights as an Applicant

As an applicant for an apartment, you have certain rights when it comes to background checks and credit checks. Landlords are required to follow specific guidelines and laws to ensure they are conducting these checks fairly and legally.

One important right is the right to be informed. Landlords must provide you with written notice that they will be conducting a background check and credit check. This notice should clearly state the type of information they will be collecting, the purpose of the check, and your right to access your report.

You also have the right to access your background check report. You can request a copy of your report and dispute any inaccuracies. If you believe there are errors in your report, you have the right to have them corrected.

It’s essential to understand that landlords are limited in the information they can use to make a decision about your application. They cannot discriminate against you based on certain factors such as your race, religion, or national origin.

It’s always a good idea to review your credit report before applying for an apartment. Knowing your credit score and understanding any negative items on your report can help you address any issues before they become a problem during the application process.

Being aware of your rights can help you navigate the apartment application process smoothly. If you have any concerns about background checks or credit checks, it’s best to consult with a legal professional.

Addressing Potential Issues Proactively

Landlords and property managers utilize background checks and credit checks as essential tools to gauge the reliability and responsibility of potential tenants. These checks serve as a proactive measure to address potential issues before they arise, creating a safer and more harmonious environment for all parties involved.

By conducting thorough checks, landlords can identify red flags such as a history of eviction, criminal activity, or poor credit history. This allows them to make informed decisions about tenant selection, minimizing the risk of encountering problematic tenants who might damage property, disrupt the community, or fail to pay rent.

Proactive measures are particularly crucial in today’s rental market, where demand for quality housing often outpaces supply. Landlords are more likely to choose tenants with a strong track record, reducing the chance of facing costly repairs, tenant disputes, or legal challenges. This proactive approach ultimately contributes to a more stable and profitable rental experience.

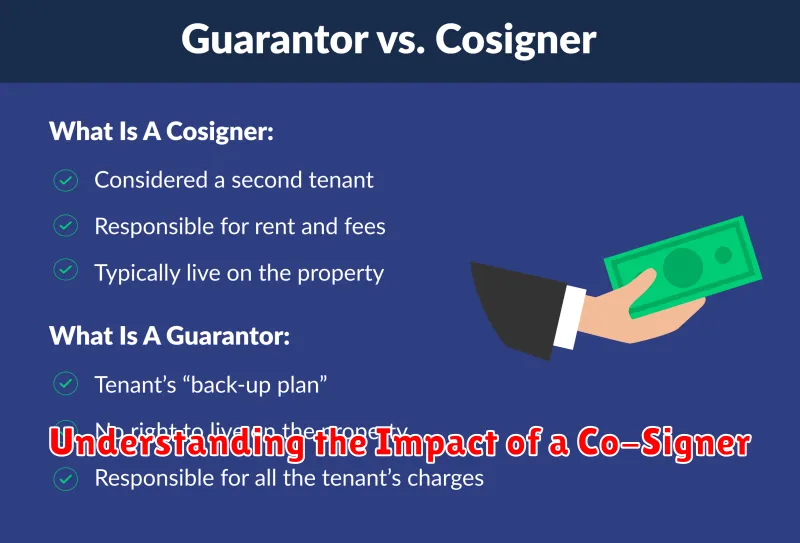

Understanding the Impact of a Co-Signer

A co-signer is an individual who agrees to be financially responsible for a lease if the primary tenant defaults on their payments. Co-signers are often used when tenants have limited credit history or poor credit scores. The presence of a co-signer can improve your chances of getting approved for an apartment, but it comes with significant responsibilities for both parties.

If the primary tenant fails to make rent payments, the landlord can pursue the co-signer for the outstanding amount. This means the co-signer could be responsible for the entire lease amount, even if they never lived in the apartment.

Here are some key considerations when involving a co-signer:

- Impact on the co-signer’s credit: The co-signer’s credit score will be affected by the tenant’s payment history. Late or missed payments will reflect on the co-signer’s credit report, potentially impacting their ability to obtain loans or credit in the future.

- Financial risk: The co-signer is legally responsible for the entire lease term, even if the primary tenant moves out. If the tenant defaults on rent, the co-signer could be held responsible for unpaid rent, damages, and other lease violations.

- Communication and trust: Open and honest communication between the tenant and co-signer is crucial. The co-signer should be aware of the potential risks and responsibilities involved.

While co-signers can be helpful in securing an apartment, it’s essential to weigh the potential impact on both parties. Co-signing is a significant financial commitment and should be taken seriously.