Are you tired of facing unexpected apartment expenses that throw your budget off track? From sudden plumbing issues to unexpected appliance repairs, these costs can quickly drain your bank account. But don’t worry! We’ve got you covered. This article will provide you with a comprehensive guide on how to budget for unexpected apartment expenses, ensuring you’re prepared for any surprises that may arise. By following our tips, you can avoid financial stress and maintain control of your finances, even when faced with the unexpected.

Creating a Realistic Apartment Budget

Unexpected expenses are a common reality for apartment dwellers. Whether it’s a sudden plumbing issue, a broken appliance, or a pest infestation, these situations can quickly drain your savings. To ensure you’re prepared for the unexpected, creating a realistic apartment budget is crucial.

Start by listing all your fixed monthly expenses, including rent, utilities, internet, and insurance. Next, add your variable expenses like groceries, transportation, entertainment, and clothing. It’s important to be honest about your spending habits and allocate funds accordingly.

When creating your budget, don’t forget to factor in an emergency fund. Aim for at least 3-6 months‘ worth of living expenses to cover unexpected repairs, medical bills, or job loss. This will provide a safety net for unforeseen circumstances.

Consider setting aside a separate maintenance fund. This dedicated pot of money can be used for minor repairs like fixing a leaky faucet or replacing a lightbulb. This will prevent small issues from escalating into larger, more expensive problems.

Finally, review your budget regularly and make adjustments as needed. Keep track of your spending and identify areas where you can save money. By creating a realistic and well-planned apartment budget, you can be better prepared for unexpected expenses and avoid financial stress.

Identifying Potential Unexpected Expenses

Moving into a new apartment can be exciting, but it’s also important to be prepared for the unexpected. Unexpected expenses can quickly derail your budget, so it’s essential to identify potential issues before they arise.

Some common unexpected expenses include:

- Repairs: Appliances breaking down, leaky faucets, or damage to the unit can all lead to unexpected repair costs.

- Pest Control: Dealing with pests like roaches, ants, or rodents can be an unexpected hassle and expense.

- Utilities: Your initial estimates for utilities like electricity, gas, and water may not be accurate, leading to higher than expected bills.

- Moving Costs: Unexpected charges related to moving, such as additional packing supplies or last-minute transportation needs, can add to your expenses.

- Security Deposits: Be prepared to pay a security deposit, which is usually refundable at the end of your lease.

It’s best to consider these potential expenses when creating your budget. Setting aside a contingency fund for unexpected costs can help you avoid financial stress.

Setting Aside an Emergency Fund for Unexpected Costs

Unexpected apartment expenses can be stressful, but having an emergency fund can provide peace of mind. When you face a sudden problem like a broken appliance or plumbing issue, a designated emergency fund can help you avoid dipping into your savings or taking on more debt.

It’s best to start small, aiming for a minimum of $500 to $1,000. This initial amount can be enough to cover minor repairs or unexpected utility bills. Once you’ve built up a cushion, you can continue to save towards a larger goal, ideally 3 to 6 months of living expenses.

Consider setting up an automatic transfer each month to your emergency fund. This can be a small amount, like $50 or $100, but it will add up over time.

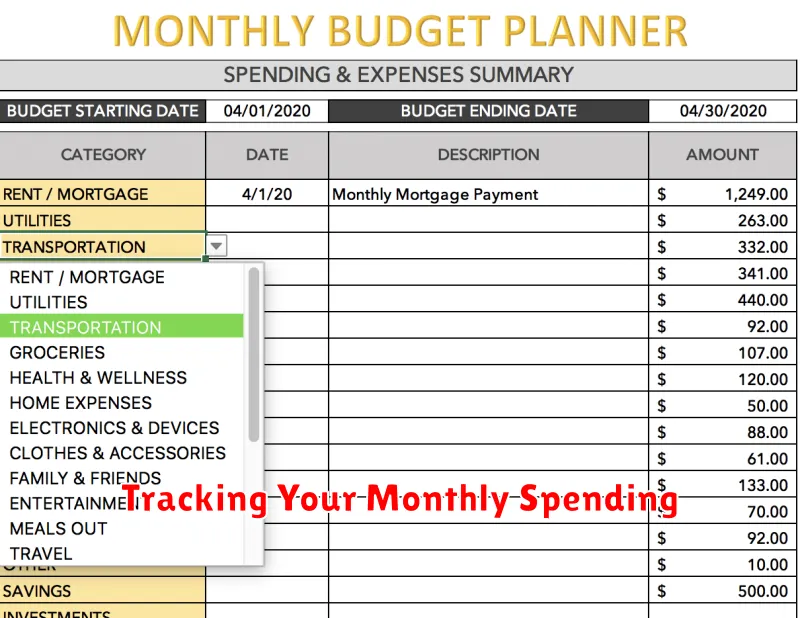

Tracking Your Monthly Spending

Before you can budget for unexpected apartment expenses, it’s essential to understand where your money is going. This means tracking your monthly spending. Start by gathering your bank statements, credit card bills, and any other receipts you may have. Once you have this information, you can begin categorizing your expenses, such as rent, utilities, groceries, transportation, and entertainment.

There are several ways to track your spending. You can use a simple spreadsheet, a dedicated budgeting app, or even just a notebook. The key is to find a method that works for you and that you’ll actually use.

Tracking your spending can help you identify areas where you might be able to save money. For example, you might find that you’re spending too much on eating out or entertainment. Once you have a better understanding of your spending habits, you can start to make adjustments to your budget.

Evaluating Your Current Financial Situation

Before you can start budgeting for unexpected apartment expenses, it’s crucial to assess your current financial situation. This involves understanding your income, expenses, and available savings. Take a close look at your bank statements, credit card bills, and any other financial documents to get a clear picture of your finances.

Identify your regular income sources, including your salary, freelance work, or any other recurring income. Then, analyze your fixed expenses, such as rent, utilities, and loan payments. Next, take note of your variable expenses, which can fluctuate, like groceries, entertainment, and transportation.

Once you have a solid understanding of your income and expenses, you can calculate your net income, which is your income minus your expenses. This will give you an idea of how much money you have available each month. Also, assess your emergency fund. Ideally, you should have at least 3 to 6 months’ worth of living expenses saved, but even a smaller amount can provide a safety net for unexpected costs.

Evaluating your current financial situation provides a foundation for creating a realistic and effective budget that accommodates unexpected apartment expenses. By understanding your income, expenses, and savings, you can make informed decisions about how to allocate your resources and prepare for financial surprises.

Finding Ways to Reduce Monthly Expenses

When faced with unexpected apartment expenses, it’s crucial to find ways to reduce your monthly outlays to free up funds for these emergencies. Here are some practical strategies to consider:

Review Your Subscription Services: Identify any recurring subscriptions you no longer use or can live without. This could include streaming services, gym memberships, or magazine subscriptions. Canceling these unnecessary expenses can free up a significant amount of money each month.

Negotiate Bills: Reach out to your service providers, such as your internet, cable, or phone company, to see if you can negotiate lower rates. Many companies are willing to offer discounts to retain customers.

Reduce Food Expenses: Analyze your grocery spending and identify areas where you can cut back. Consider buying generic brands, cooking more meals at home, and avoiding unnecessary takeout. By preparing your meals, you can save a substantial amount on food costs.

Optimize Energy Consumption: Lower your utility bills by reducing energy consumption. Unplug unused electronics, turn off lights when leaving rooms, and use energy-efficient appliances. Simple changes can make a difference in your monthly energy expenses.

Cut Back on Entertainment: Entertainment expenses can quickly add up. Explore free or low-cost entertainment options, such as attending local events, visiting parks, or enjoying hobbies that don’t require spending money.

By implementing these strategies, you can significantly reduce your monthly expenses and free up funds to handle unexpected apartment costs. Remember, every dollar saved contributes to your financial security and preparedness for life’s uncertainties.

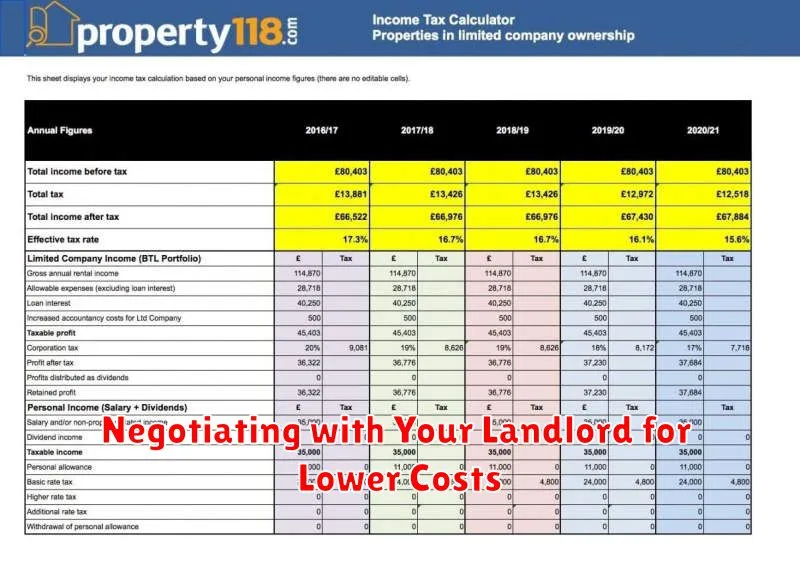

Negotiating with Your Landlord for Lower Costs

Landlords are often open to negotiating, especially if they are looking to fill a vacant unit or keep a good tenant. When negotiating, it’s important to be polite and respectful. Be prepared to explain your situation and why you need a lower rent or lower cost for an amenity.

Here are some tips for negotiating with your landlord:

- Be prepared to walk away. If you’re not happy with the offer, be willing to walk away. This shows the landlord that you’re serious about your needs.

- Be flexible. You may not get everything you want, but you may be able to compromise on some things.

- Focus on long-term benefits. Highlight how staying in the apartment will be beneficial for the landlord, such as increased stability and less turnover.

- Offer to pay a security deposit. This shows the landlord that you’re serious about staying in the apartment and that you’re a responsible tenant.

- Offer to sign a longer lease. This gives the landlord the security of knowing that they’ll have a tenant for a longer period of time. They may be more willing to lower the rent in exchange for a longer lease term.

- Be willing to negotiate on other aspects. For example, you may be able to negotiate a lower rent in exchange for taking on more responsibility for the apartment, such as taking care of the lawn or snow removal.

Exploring Renters Insurance Options

Renters insurance is a crucial component of your apartment budget, offering protection against unforeseen events that could leave you financially burdened. While it’s not mandatory, it’s a wise investment to safeguard your belongings and personal liability.

Coverage Options

Renters insurance typically covers a range of scenarios, including:

- Personal property: Covers damage or theft of your belongings within your apartment, including furniture, electronics, and clothing.

- Liability: Protects you if someone is injured on your property and you are found liable.

- Additional living expenses: Provides temporary housing and living expenses if you are unable to live in your apartment due to a covered event.

Choosing the Right Policy

When selecting renters insurance, consider these factors:

- Coverage limits: Determine the amount of coverage you need based on the value of your possessions.

- Deductible: The amount you pay out-of-pocket before your insurance covers the rest.

- Premium: The monthly cost of your policy, which can vary based on coverage levels and your location.

Finding Affordable Options

Several strategies can help you find affordable renters insurance:

- Shop around: Compare quotes from multiple insurers to find the best price.

- Bundle policies: Combining renters insurance with auto insurance can often result in discounts.

- Increase your deductible: A higher deductible generally translates to lower premiums.

By exploring your renters insurance options, you can create a budget that includes protection from unexpected apartment expenses, giving you peace of mind and financial security.

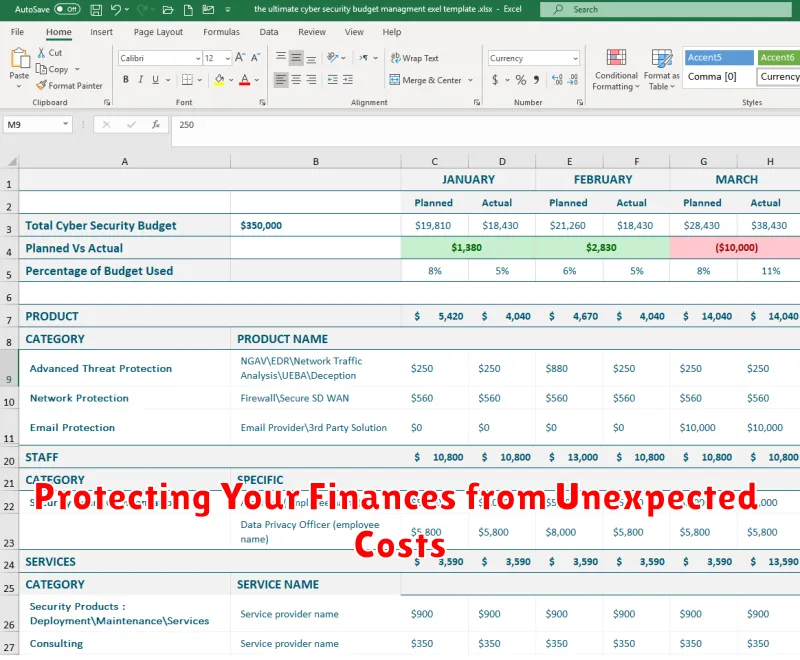

Protecting Your Finances from Unexpected Costs

Life is full of surprises, and some of them can be costly. Unexpected apartment expenses are a common occurrence, and they can wreak havoc on your budget if you’re not prepared. From sudden appliance breakdowns to unexpected repairs, these costs can quickly drain your savings and leave you feeling stressed.

The key to staying financially secure is to proactively protect yourself from these unforeseen expenses. By building an emergency fund and understanding the potential costs associated with apartment living, you can avoid financial hardship when the unexpected strikes.

An emergency fund is a crucial part of your financial safety net. This dedicated savings account acts as a buffer to absorb unexpected costs like appliance repairs, plumbing issues, or even sudden job loss. Aim to save 3-6 months’ worth of living expenses in your emergency fund.

Beyond an emergency fund, understanding your apartment’s lease agreement and the potential costs associated with it is crucial. Familiarize yourself with the terms related to maintenance, repairs, and tenant responsibilities. This knowledge will help you identify potential areas where unexpected costs might arise.

Remember, being prepared is key to safeguarding your finances. By proactively creating a financial safety net, you’ll be better equipped to navigate the inevitable surprises life throws your way, allowing you to live with greater peace of mind.

Building a Strong Financial Foundation

Unexpected apartment expenses can be stressful, but they are also a part of life. By budgeting for them, you can avoid financial surprises and build a strong financial foundation. This means having enough money saved to cover not only your regular living expenses but also unexpected costs.

A strong financial foundation is like a safety net. It gives you the peace of mind to know that you can handle unexpected events without having to borrow money or go into debt. It also gives you the freedom to make other financial goals, such as saving for retirement or buying a home.

Here are a few tips for building a strong financial foundation:

- Create a budget and stick to it. A budget will help you track your income and expenses so you can see where your money is going. This will make it easier to identify areas where you can save money.

- Save for emergencies. An emergency fund will help you cover unexpected costs such as medical bills, car repairs, or apartment repairs. Aim to save 3-6 months of living expenses.

- Pay down debt. High-interest debt can eat away at your savings. Pay down your debts as quickly as possible to free up more money for your emergency fund and other financial goals.

- Invest for the future. Investing your money can help it grow over time. Start small and invest consistently to build a strong portfolio.

By following these tips, you can build a strong financial foundation that will help you weather any storm. It will give you the confidence to know that you are prepared for whatever life throws your way.

Managing Unexpected Apartment Expenses Effectively

Unexpected apartment expenses are a common part of renting. Whether it’s a leaky faucet, a broken appliance, or a sudden pest infestation, these unforeseen costs can quickly strain your budget. Thankfully, with a bit of planning and proactive measures, you can manage these expenses effectively.

First, it’s crucial to have an emergency fund specifically dedicated to unexpected apartment expenses. This fund should cover at least a few months’ worth of rent and potential repair costs. Building this fund gradually over time will provide a financial safety net for when the unexpected arises.

Second, familiarize yourself with your lease agreement. Understand what repairs are your responsibility as a tenant and what the landlord is obligated to handle. This will prevent confusion and ensure that you’re not shouldering costs that aren’t rightfully yours.

Third, consider purchasing a rental insurance policy. While not always mandatory, it can provide coverage for damage caused by events like fire, theft, or water damage, offering additional financial protection.

Finally, be proactive in maintaining your apartment. Regularly inspect appliances, report any potential issues to your landlord promptly, and practice good preventative measures. By taking these steps, you can minimize the likelihood of costly repairs in the future.

Remember, managing unexpected apartment expenses effectively is all about being prepared and responsible. By setting aside funds, understanding your lease, and taking preventative measures, you can navigate these unforeseen costs with greater ease and avoid financial strain.