Building credit is a crucial aspect of achieving financial stability and unlocking access to various financial products like loans, mortgages, and credit cards. While many associate credit building with homeownership, renting an apartment presents a valuable opportunity to establish and enhance your credit score. This article will delve into practical strategies and effective methods to build credit while renting, empowering you to improve your financial standing and secure a brighter financial future.

Understanding the Importance of Building Credit

Having a good credit score is essential for many aspects of your financial life. It can influence your ability to get a loan for a car, a mortgage for a house, or even an apartment rental. Credit scores are based on your history of paying bills on time and managing debt responsibly.

A strong credit score can help you secure better interest rates on loans, qualify for more favorable rental terms, and even land certain jobs. Conversely, a low credit score can lead to higher interest rates, difficulty securing loans, and a less favorable rental experience.

Reporting Rent Payments to Credit Bureaus

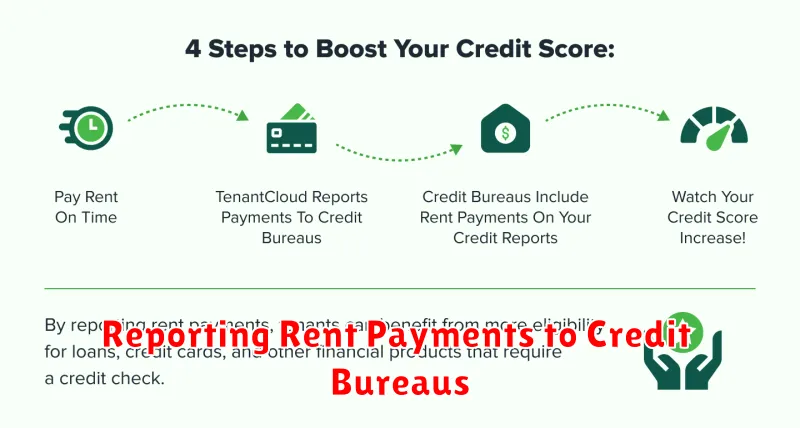

One of the biggest challenges for renters when it comes to building credit is that their rent payments aren’t typically reported to the credit bureaus. This means that even if you’re a reliable renter, your positive payment history isn’t reflected in your credit score. However, there are ways to get your rent payments reported to the credit bureaus, which can help you build a strong credit history.

Several companies specialize in rent reporting. These companies work with landlords to collect rent payment data and report it to the major credit bureaus. The process usually involves signing up for the service, providing your landlord’s information, and authorizing the company to access your rent payment data. Once enrolled, your on-time rent payments will be reported to the credit bureaus, positively impacting your credit score.

It’s important to note that not all landlords participate in rent reporting programs. You can inquire with your landlord about their participation or encourage them to sign up for a service. If your landlord isn’t willing to participate, you can explore other options, such as using a credit-building service that works directly with you to report your rent payments.

Reporting your rent payments to credit bureaus is a valuable step toward building a strong credit history, especially if you’re a renter. By taking advantage of these services, you can demonstrate your financial responsibility and improve your credit score, opening doors to various financial opportunities.

Using a Secured Credit Card to Establish Credit History

One of the most effective ways to build credit while renting is through a secured credit card. Secured credit cards require a security deposit, typically in the form of a cash deposit, which acts as collateral. This deposit limits your spending to the amount you deposited, reducing the lender’s risk. This makes them a good option for people with limited or no credit history.

The primary benefit of using a secured credit card is that it allows you to start building a positive credit history. Every on-time payment and responsible use of your credit card is reported to the credit bureaus, which helps establish your creditworthiness over time. Once you demonstrate responsible credit card usage, you may be eligible to graduate to an unsecured credit card with a higher credit limit.

When choosing a secured credit card, compare annual fees, interest rates, and credit limits. Look for cards with features such as rewards programs or travel perks to maximize your benefits. It’s important to utilize your card responsibly. Make sure to pay your bill on time each month and keep your balance low to maintain a healthy credit utilization ratio. This will help you build a positive credit history and ultimately improve your credit score.

Becoming an Authorized User on a Credit Card Account

If you’re renting an apartment and looking to build credit, becoming an authorized user on a credit card account is a great option. An authorized user is someone who is allowed to use a credit card account, even though they’re not the primary account holder. This can help you build credit history without having to apply for your own credit card.

To become an authorized user, you’ll need to find a credit card holder who’s willing to add you to their account. This is often a family member or close friend. The primary account holder can add you as an authorized user online or by calling their credit card issuer. You’ll typically need to provide your Social Security number and other personal information.

Once you’re added as an authorized user, your credit history will be linked to the primary account holder’s. This means that any payments they make on the account will be reflected on your credit report. However, you’ll also be responsible for any debt incurred on the card, even if you didn’t make the purchases.

Before becoming an authorized user, it’s important to talk to the primary account holder about their credit habits. Make sure they have a good payment history and aren’t using the card close to its credit limit. You can also ask them to keep you updated on their spending habits and credit score.

Taking Out a Credit-Builder Loan

A credit-builder loan is a type of loan that can help you establish or build credit. The lender will keep your loan payments in a savings account and release the funds to you once you’ve repaid the loan. The payments you make will be reported to the credit bureaus, which will help build your credit score.

To qualify for a credit-builder loan, you’ll likely need to have a checking account and a steady income. The interest rates on credit-builder loans are often low, but there are usually no interest rate benefits for paying back the loan early. If you’re looking for a way to build credit, a credit-builder loan can be a good option, as it will help you establish a positive payment history and build up your credit score over time.

Here are some things to keep in mind when considering a credit-builder loan:

- Check the interest rates and fees. Some lenders charge high fees for credit-builder loans.

- Make sure the lender reports your payments to the credit bureaus.

- If you’re looking to build credit quickly, a credit-builder loan may not be the best option for you.

It’s important to research the terms and conditions before taking out a credit-builder loan, just like you would with any other loan.

Paying Bills on Time and in Full

One of the most important things you can do to build credit while renting is to pay your bills on time and in full. This includes rent, utilities, and any other recurring bills you may have. When you pay your bills on time, it shows lenders that you are a responsible borrower. This will help you qualify for loans in the future with better interest rates.

Set up automatic payments or reminders for your bills to help you stay on top of them. You can also consider using a credit card for your recurring bills, and paying the balance in full each month. This will help you build your credit history, as long as you are responsible with your spending.

Building good credit takes time and effort, but it is worth it in the long run. By paying your bills on time and in full, you can establish a positive credit history that will benefit you for years to come.

Monitoring Your Credit Report Regularly

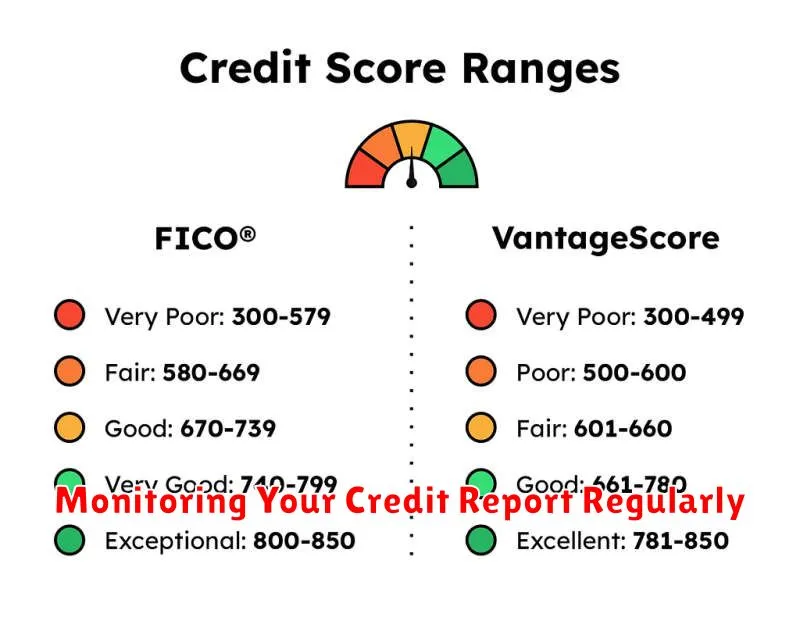

While you may be unable to build credit by directly paying rent, regularly monitoring your credit report plays a crucial role in ensuring your financial well-being. Your credit report is a detailed record of your financial history, including all your accounts, loans, and payment history. By keeping a close eye on it, you can identify any errors or fraudulent activity that could impact your credit score.

You can obtain a free credit report from all three major credit bureaus – Equifax, Experian, and TransUnion – once a year through AnnualCreditReport.com. Review your report meticulously, paying attention to the following:

- Personal Information: Ensure your name, address, and other personal details are accurate.

- Accounts: Verify all your accounts are listed correctly and that no unauthorized accounts have been opened.

- Payment History: Check for any discrepancies or late payments that may negatively impact your credit score.

By monitoring your credit report regularly, you can catch and resolve any issues promptly, safeguarding your financial standing and contributing to a healthy credit score, even while you’re renting.

Avoiding Excessive Debt and Maintaining a Healthy Credit Utilization Ratio

While renting an apartment, you can still build a strong credit history by making on-time payments for utilities, phone bills, and other recurring expenses. However, it’s crucial to be cautious about taking on excessive debt, especially revolving credit like credit cards. Aim to keep your credit utilization ratio—the percentage of available credit you’re using—below 30%.

A high credit utilization ratio can negatively impact your credit score. It signals to lenders that you’re heavily reliant on credit and may be struggling to manage your finances.

Here are some tips for avoiding excessive debt and maintaining a healthy credit utilization ratio:

- Use credit cards responsibly. Pay your credit card balances in full each month. If you can’t afford to do so, try to pay more than the minimum amount due.

- Avoid opening too many credit cards. Opening too many credit cards can lower your credit score, as it can increase your credit utilization ratio. You can also get caught up in the temptation to spend more.

- Monitor your credit utilization ratio. You can check your credit utilization ratio for free online. Be aware of your utilization rate, and aim to keep it below 30%.

By following these tips, you can build a strong credit history while renting and avoid the pitfalls of excessive debt.