Are you looking for a new apartment but worried about getting approved? Don’t fret! While getting approved for an apartment can seem daunting, it’s not impossible. With the right strategy and understanding of what landlords look for, you can significantly increase your chances of securing that perfect place. This article will delve into crucial tips and tricks to help you boost your approval odds, from improving your credit score to crafting an impressive application and ensuring your finances are in order. Ready to take control of your apartment hunt? Let’s dive in!

Understanding the Application Process

The application process can be daunting, but understanding the steps involved can make it less stressful. The first step usually involves filling out an application form, which requires personal information, employment history, and rental history. It’s important to be honest and accurate, as landlords will often run background checks to verify the information you provide. You may also be asked to provide references from previous landlords or employers.

Next, you’ll likely be asked to submit a security deposit and the first month’s rent, which is often collected in the form of a cashier’s check or money order. Some landlords may also require additional fees, such as an application fee or a pet deposit. Make sure to ask about all applicable fees upfront to avoid surprises.

Once you’ve submitted your application and supporting documentation, the landlord will review it and make a decision. If approved, you’ll be notified and given a lease agreement to sign. Be sure to read the lease agreement carefully before signing it, as it outlines your responsibilities as a tenant and any terms you agree to.

The application process can vary slightly depending on the landlord and the property, so it’s essential to communicate with the landlord and ask any questions you have. Being proactive and organized throughout the process can help you increase your chances of getting approved for an apartment.

Checking Your Credit Score and History

Landlords use your credit score and history as a key factor in deciding whether to rent to you. A good credit score shows a landlord that you’re financially responsible and likely to pay your rent on time. A poor credit score, on the other hand, could make a landlord hesitant.

To increase your chances of getting approved, check your credit score and history before you apply for an apartment. You can get a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. You can also use a credit monitoring service to track your credit score and receive alerts about changes.

Review your credit report carefully for any errors. If you find any mistakes, dispute them with the credit bureaus. You should also pay down any outstanding debts, such as credit card balances, to improve your credit score.

If your credit score is low, consider working with a credit counseling agency to develop a plan to improve it.

Gathering Necessary Documentation

Before you even start looking for an apartment, it’s crucial to gather all the necessary documentation to ensure a smooth application process. Landlords typically require specific documents to assess your financial stability and rental history. Here are some essential documents to prepare:

- Proof of Income: This could include pay stubs, bank statements, tax returns, or a letter of employment.

- Photo ID: A driver’s license, passport, or government-issued ID.

- Credit Report: Your credit score plays a significant role in your chances of approval. Get a copy of your credit report and address any errors.

- Rental History: If you’ve rented before, have your previous landlords provide a written reference, including your rental period, payment history, and any incidents.

- References: Provide personal references from individuals who can attest to your character and responsibility.

- Bank Statements: Landlords may want to see recent bank statements to verify your financial stability.

- Co-Signer Information: If you’re using a co-signer, gather their documentation as well.

Having all this documentation organized and readily available will streamline the application process and demonstrate your seriousness as a potential tenant. Be prepared to provide these documents promptly, as landlords may want to review them before scheduling a viewing.

Showcasing Your Income and Employment Stability

Landlords want to ensure that you can afford the rent and that you’re a reliable tenant. Demonstrating your income and employment stability can significantly boost your chances of approval. Provide clear documentation of your income, such as recent pay stubs or a tax return. If you’re self-employed, have a letter from your accountant or tax professional verifying your income. A consistent employment history is also crucial. If you’ve been at your current job for a while, emphasize it. If you’ve had multiple jobs, be prepared to explain any gaps in employment.

Providing Strong References

When applying for an apartment, providing strong references is crucial. References demonstrate your reliability and trustworthiness to potential landlords. Here’s how to ensure your references give a positive impression:

Choose the right references: Select individuals who have known you for a significant period and can speak to your character, financial responsibility, and ability to pay rent on time. Landlords often prefer references from previous landlords, employers, or other trusted individuals who have a strong understanding of your rental history.

Inform them in advance: Reach out to your references beforehand and inform them about the application process. Give them a heads-up that they may receive a call or email from a potential landlord. This allows them to be prepared and provide accurate information.

Provide contact information: Ensure you have accurate and up-to-date contact information for all your references. Include their full names, phone numbers, email addresses, and relationship to you. Providing detailed information makes it easier for landlords to reach your references.

Consider a reference letter: A reference letter is a formal document written by your reference outlining your positive qualities and suitability as a tenant. This can be a helpful addition to your application, especially if you have limited rental history or are worried about negative feedback.

By taking these steps, you can maximize the impact of your references and increase your chances of getting approved for your desired apartment.

Preparing for the Interview

The interview is your chance to shine and make a good impression. Here are some tips to prepare:

Research the property: Before the interview, take the time to familiarize yourself with the apartment complex or building. Learn about the amenities, the neighborhood, and any special rules or policies. This will show the landlord that you’re genuinely interested and that you’ve done your homework.

Prepare your questions: The interview is a two-way street. Have some thoughtful questions ready to ask the landlord about the property, the neighborhood, and the application process. This shows that you’re engaged and eager to learn more.

Dress appropriately: While you don’t need to dress formally, it’s important to present yourself professionally. Choose clean and comfortable clothes that are appropriate for the occasion. This shows respect for the landlord and the property.

Bring all necessary documents: Be prepared to provide any documentation that may be requested, such as your driver’s license, proof of income, and rental history. Having these documents readily available will save time and demonstrate your preparedness.

Practice your answers: Anticipate common interview questions and rehearse your responses. This will help you feel more confident and articulate during the interview.

Be punctual: Punctuality is crucial. Arrive at the interview on time or even a few minutes early. This demonstrates your respect for the landlord’s time.

Be enthusiastic and positive: Show genuine interest in the apartment and the property. Your enthusiasm and positive attitude will make a lasting impression.

Highlighting Your Positive Rental History

A strong rental history is a significant factor in getting approved for an apartment. Landlords want to ensure that their tenants are responsible, pay rent on time, and take care of the property. Highlighting your positive rental history can make a big difference in your application.

When applying for an apartment, provide contact information for all your previous landlords. If possible, get written recommendations from your previous landlords stating that you were a good tenant. This can be a powerful tool to convince the current landlord of your reliability.

If you have a gap in your rental history, be prepared to explain it. Landlords might be hesitant about applicants with gaps in their rental history. However, if you can explain the reason for the gap, it can alleviate their concerns. For example, explain you were living with family, traveling abroad, or focusing on school.

It’s a good idea to keep track of your rental history, including dates of residency, rent payments, and any issues you encountered with your landlord. This will help you when filling out applications and in case you need to provide proof of your rental history.

By highlighting your positive rental history, you demonstrate to landlords that you are a responsible tenant who is likely to take good care of their property. This can significantly increase your chances of getting approved for your dream apartment.

Being Honest and Transparent

When applying for an apartment, landlords want to ensure you’re a reliable tenant. This means being upfront and honest about your financial situation, employment history, and any other relevant factors. Don’t try to embellish your income, downplay debt, or hide negative information. Landlords can easily verify information, and any inconsistencies will raise red flags.

Being honest also extends to your intentions. If you’re looking for a temporary rental, be open about it. Landlords may be hesitant to rent to someone who’s not planning to stay long-term. By being clear about your needs, you increase your chances of finding a landlord who’s willing to accommodate them.

Transparency builds trust. When landlords feel like they can trust you, they’re more likely to approve your application. By being honest and transparent from the beginning, you’re setting a foundation for a positive landlord-tenant relationship.

Following Up After the Application

After submitting your application, it’s crucial to follow up with the landlord or property manager. This shows that you’re genuinely interested in the apartment and proactive. Wait a couple of days after submitting your application before making contact. You can call or email, but a phone call is often more effective. Ask about the status of your application and reiterate your interest in the apartment. Be polite and professional, and express your availability for a viewing or to answer any questions they may have.

If you don’t hear back within a week, it’s okay to follow up again. Be persistent, but avoid being pushy or demanding. If you’re not selected for the apartment, don’t be discouraged. The landlord may have chosen another applicant or the apartment may have been taken off the market. You can use this as an opportunity to ask for feedback on your application, which can help you improve your chances in future applications.

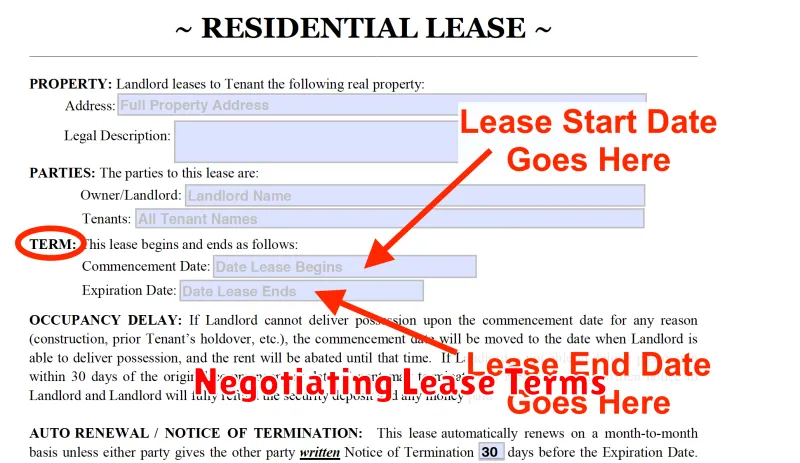

Negotiating Lease Terms

While most apartment lease terms are non-negotiable, there are still some areas where you might have some wiggle room. Here are a few things you can try to negotiate:

- Move-in date: If you need to move in on a specific date that’s not the standard lease start date, you might be able to negotiate a different start date.

- Security deposit: Depending on the market and the landlord’s policies, you might be able to negotiate a lower security deposit.

- Pet deposit: If you have a pet, you might be able to negotiate a lower pet deposit or even get it waived altogether.

- Lease length: You might be able to negotiate a shorter or longer lease term, depending on the landlord’s needs.

- Rent: While you’re unlikely to get a significant discount on rent, you might be able to negotiate a small reduction, especially if you’re willing to sign a longer lease or if the apartment has been on the market for a while.

When negotiating, be polite and professional. Be prepared to explain your reasons for wanting to negotiate, and be willing to compromise. It’s important to remember that the landlord ultimately has the final say. But by being prepared and understanding the market, you can increase your chances of getting approved for the apartment you want and negotiating favorable lease terms.

Understanding Guarantors and Co-signers

When you apply for an apartment, landlords often require you to have a guarantor or co-signer, especially if you have a low credit score or limited rental history. These individuals agree to be financially responsible for your rent payments if you default. Understanding the differences between guarantors and co-signers can be helpful in securing your dream apartment.

A guarantor is usually a family member or close friend who agrees to cover your rent payments if you fail to do so. While they are responsible for your rent, they don’t typically have the right to live in the apartment. A guarantor is generally not obligated to cover any other expenses, such as utilities or damages.

A co-signer, on the other hand, is more directly involved in the lease agreement. They are essentially a joint tenant and have the same rights and obligations as you, including the right to live in the apartment. Co-signers are typically required to have good credit and income, as they are jointly responsible for all aspects of the lease.

Having a guarantor or co-signer can significantly improve your chances of getting approved for an apartment, especially if you have a limited credit history or income. However, it’s important to discuss your responsibilities with them upfront and ensure they understand the potential financial burden they are taking on.

Presenting Yourself Professionally

When you’re applying for an apartment, it’s crucial to present yourself professionally. This means going beyond simply filling out an application. Your demeanor and approach can make a significant difference in the landlord’s perception of you.

Here are some key tips for presenting yourself professionally:

- Be Punctual: Show up for your apartment viewing on time. This demonstrates your respect for the landlord’s time and your commitment to the process.

- Dress Appropriately: While you don’t need to wear a suit, dressing in neat and presentable clothing conveys professionalism and respect.

- Be Polite and Respectful: Be courteous to the landlord or property manager. Ask thoughtful questions about the apartment and neighborhood, and express genuine interest in the property.

- Be Prepared: Bring all necessary documents, such as your driver’s license, pay stubs, and references. Having everything ready demonstrates organization and preparedness.

- Follow Up: After your viewing, send a thank-you note or email to the landlord. This reinforces your interest in the apartment and shows your appreciation for their time.

Remember, presenting yourself professionally doesn’t just involve your appearance but also your attitude and actions. By following these tips, you’ll increase your chances of making a favorable impression on the landlord and securing your dream apartment.

Being Flexible with Move-in Dates

One of the simplest ways to increase your chances of getting approved for an apartment is to be flexible with your move-in date. Landlords often have a preferred move-in date for a unit, and they may be more likely to choose an applicant who can accommodate that date. If you’re able to move in on a date that’s earlier or later than your ideal date, let the landlord know that you’re open to different options.

Being flexible with your move-in date shows the landlord that you’re serious about renting the apartment and that you’re willing to work with them. It can also help you stand out from other applicants who are more inflexible. If you’re able to be flexible, be sure to communicate that to the landlord during your application process. For example, you could say, “I’m hoping to move in by [your ideal date], but I’m open to other dates as well.”