Are you a young adult or recent graduate looking to rent your first apartment? Maybe you’re a college student who’s ready to live off-campus. Whatever the reason, finding an apartment without a cosigner can be a challenge. Landlords often require cosigners to ensure that the rent will be paid on time, especially for those with limited credit history or income. But don’t despair! This guide will provide you with practical tips and strategies to successfully rent an apartment without a cosigner and achieve your dream of independent living.

Understanding the Role of a Cosigner

A cosigner is an individual who agrees to be financially responsible for a renter’s lease if the renter fails to pay rent or meet other lease obligations. In essence, the cosigner acts as a guarantor, ensuring the landlord receives payment. While a cosigner is not required for every rental, they can be crucial for individuals with limited credit history or income.

Think of a cosigner as a safety net for the landlord. If the renter defaults on the lease, the landlord can turn to the cosigner for payment. Cosigners are typically someone the renter trusts, like a family member or close friend, who has good credit and a stable income.

It’s important to note that being a cosigner is a significant responsibility. Cosigners are legally obligated to cover the renter’s financial obligations, which can have a substantial impact on their own credit scores and finances. It is crucial for both the renter and cosigner to understand the risks involved before signing the lease.

Why Landlords Often Require a Cosigner

Landlords require cosigners for a variety of reasons, most of which boil down to risk management. They want to be sure they can collect rent and cover any damages to the property. Cosigners provide an extra layer of financial security, acting as a safety net in case the primary renter falls short.

Here are some common scenarios where a landlord might request a cosigner:

- Limited credit history: If you’re young or have a short credit history, landlords may worry about your ability to make timely payments. A cosigner with a strong credit history can alleviate this concern.

- Low credit score: A low credit score can be a red flag for landlords, indicating potential financial instability. A cosigner with a good credit score can help offset this risk.

- Limited income: If your income doesn’t meet the landlord’s minimum requirements, a cosigner’s income can be factored in to ensure financial stability.

- Past financial challenges: If you have a history of late payments or missed rent, a cosigner can show the landlord that you have someone backing you up.

While cosigners are often seen as a necessity for individuals with less-than-ideal credit, it’s important to remember that landlords can also require cosigners for other reasons. Ultimately, their goal is to mitigate risk and ensure they have a reliable tenant.

Alternatives to Having a Cosigner

If you’re struggling to rent an apartment because you don’t have a cosigner, there are a few alternative options available. These might include:

Offering a Larger Security Deposit: A larger security deposit can help offset the risk for a landlord, making you a more attractive renter. Make sure you can comfortably afford to pay a higher security deposit before offering it.

Paying More Rent: Similar to a higher security deposit, offering to pay a higher monthly rent can incentivize a landlord to approve your application.

Providing Proof of Income: A steady income is a strong indicator of your ability to pay rent on time. Offer your pay stubs, bank statements, or any other documentation that can demonstrate your income.

Getting a Letter of Recommendation: A positive letter of recommendation from a previous landlord or employer can strengthen your application. This shows that you’re a reliable and responsible tenant.

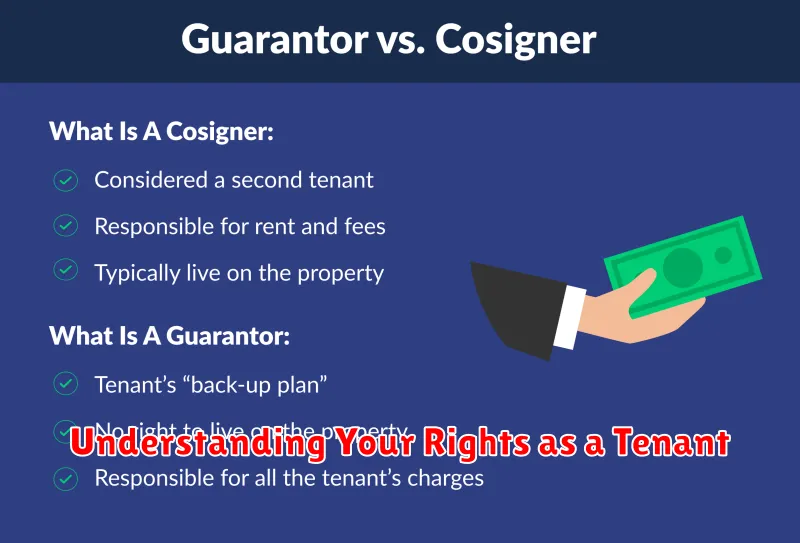

Finding a Guarantor: A guarantor is similar to a cosigner, but instead of sharing legal responsibility for the lease, they agree to be financially responsible if you default on payments. This can be a good option if you have a close friend or family member who’s willing to help.

Building a Strong Rental Application Without a Cosigner

When you’re trying to rent an apartment, having a cosigner can be a huge benefit. But what if you don’t have one? Don’t worry, there are still ways to build a strong rental application that will impress potential landlords. Here are some tips:

1. Demonstrate a strong credit history: Landlords want to make sure you’ll be able to pay your rent on time. A good credit score is a great way to prove your financial responsibility. If you have a low credit score, consider working on improving it before applying for apartments.

2. Show a steady income: Landlords want to see that you have a reliable source of income. Be prepared to provide pay stubs, bank statements, or other documentation that demonstrates your income. If you have a fluctuating income, consider getting a letter of employment confirming your job status and salary.

3. Offer a security deposit or advance rent: Offering a larger security deposit or advance rent payments can make you more attractive to landlords. This demonstrates your commitment to the lease and can offset any concerns they may have about your financial history.

4. Be a great tenant: Show landlords that you’re a responsible and respectful tenant. Be on time for appointments, be communicative and polite, and be prepared to answer any questions they may have.

5. Be transparent: If you have any blemishes on your rental history, be honest about them. Explain what happened and what you’ve learned from it. Honesty and taking responsibility for your actions will show landlords that you’re a trustworthy tenant.

Building a strong rental application without a cosigner can be challenging, but it’s not impossible. By demonstrating your financial responsibility, providing documentation to support your income, and being a good tenant, you can increase your chances of being approved.

Providing Proof of Income and Financial Stability

Landlords want to be sure that you can afford to pay your rent on time and consistently. Providing proof of income and financial stability demonstrates your ability to do so and is often a requirement for renting an apartment without a cosigner.

Here’s what you can do:

- Provide pay stubs: This is the most common way to prove your income. Provide your most recent pay stubs, or a full month’s worth, if possible.

- Offer bank statements: Bank statements can show your income and spending habits, as well as your financial stability.

- Submit tax returns: Your tax returns are a good way to document your income, especially if you are self-employed or have other income sources.

- Provide a letter of employment: This letter should state your job title, salary, and length of employment.

If you are self-employed, be prepared to provide additional documentation to prove your income, such as invoices, contracts, and business bank statements.

Demonstrating a Positive Rental History

One of the biggest hurdles for renters without a cosigner is proving their financial stability and responsibility. This is where a strong rental history comes in. Landlords want to see a consistent track record of on-time rent payments, responsible tenant behavior, and a history of maintaining the property well. This demonstrates that you are a reliable and trustworthy tenant.

If you have limited rental history, don’t worry! There are ways to build a positive track record. Consider these strategies:

- Start small: Look for smaller, more affordable units that may be more open to accepting tenants with less rental history. Even a short-term lease can be a valuable starting point.

- Get a room rental: Renting a room from a homeowner can be a great way to establish a positive rental history. It shows you’re willing to share space and responsibility, which can be attractive to landlords.

- Offer additional security: To offset the lack of rental history, consider offering additional security measures like a larger security deposit or a letter of recommendation from a previous landlord. This shows your commitment to being a responsible tenant.

Remember, building a positive rental history takes time and effort. By demonstrating your reliability and commitment to being a good tenant, you’ll increase your chances of securing an apartment without a cosigner.

Offering a Larger Security Deposit or Pre-Paid Rent

If you’re struggling to rent an apartment due to a lack of credit history or low income, consider offering a larger security deposit or pre-paid rent. This can show the landlord that you’re financially responsible and serious about renting the apartment. Many landlords are willing to negotiate on these terms, especially if it makes them feel more secure about your ability to pay rent on time. Be sure to communicate clearly with the landlord about your intentions and any specific terms you’d like to negotiate. This can be a helpful strategy to secure an apartment without a cosigner, but be prepared to have a detailed discussion with the landlord and potentially provide documentation of your financial stability.

Securing a Guarantor for Your Lease

If you don’t meet the requirements to rent an apartment on your own, a guarantor can be a lifesaver. A guarantor is someone who agrees to be financially responsible for your lease if you fail to pay rent or break the lease agreement.

To secure a guarantor, you’ll need to find someone who meets the landlord’s criteria, such as having good credit and sufficient income. This could be a parent, family member, or close friend. You’ll need to get their written consent and have them sign a guarantor agreement.

The guarantor agreement will outline their responsibilities and the circumstances under which they’d be required to fulfill them. It’s essential to understand the terms of the agreement and ensure your guarantor fully understands their obligations.

Here are some tips for finding a guarantor:

- Start with family and close friends: These individuals are likely to be more willing to help.

- Be honest and transparent: Explain your situation and the requirements of the guarantor agreement.

- Offer incentives: Consider offering a small gift or gesture of appreciation to your guarantor.

- Be prepared to provide documentation: Your guarantor will likely need to provide proof of income and credit history.

Finding No-Cosigner Apartment Options

If you’re struggling to find an apartment without a cosigner, don’t despair! There are several options available to you. Here are a few things you can do to increase your chances of securing a lease:

1. Consider shorter-term leases: Many landlords are more willing to rent to tenants without cosigners for shorter lease terms. This could be a good option if you’re only looking to rent for a few months or a year.

2. Look for apartments in smaller buildings: Smaller buildings often have more flexible rental policies than large apartment complexes. You may have more luck finding an apartment without a cosigner in a smaller building.

3. Be prepared to pay a larger security deposit: Landlords may require a larger security deposit from tenants without cosigners to offset the risk. Be prepared to pay a higher deposit if you need to rent without a cosigner.

4. Build your credit score: Having a good credit score can make you a more attractive tenant to landlords. If your credit score is low, consider taking steps to improve it.

5. Offer to pay additional rent: If you can afford it, offer to pay a higher monthly rent to make yourself a more appealing candidate.

6. Be upfront about your situation: When you’re applying for an apartment, be honest about your situation and explain why you need to rent without a cosigner. Many landlords are understanding and willing to work with tenants who are transparent about their circumstances.

7. Seek out landlords who specialize in renting to students or young professionals: Many landlords target specific demographics, such as students or young professionals. These landlords may be more willing to work with tenants who don’t have a cosigner.

Remember to be persistent and don’t give up! With some effort, you’ll be able to find the perfect apartment without a cosigner.

Negotiating with Landlords on Cosigner Requirements

If you’re facing a cosigner requirement from a landlord, don’t automatically give up. You may be able to negotiate your way out of it by presenting a strong case for your financial stability and responsibility.

Here are some key points to consider:

- Credit Score: If you have a good credit score, emphasize it. Share your credit report with the landlord, highlighting your positive payment history and low credit utilization.

- Income: Demonstrate your income stability by providing pay stubs, bank statements, or employment verification. If you have a stable job with a consistent income, this can be a strong argument against the cosigner requirement.

- Rental History: If you’ve rented before and have a positive history of paying rent on time, provide this information to the landlord. Past positive rental experiences can be reassuring.

- Guarantor vs. Cosigner: A guarantor is typically only responsible if you default on rent, while a cosigner is jointly liable for the lease. Ask if a guarantor is acceptable instead of a cosigner. This might be a less demanding option for the landlord.

- Offer a Security Deposit Increase: Consider offering a larger security deposit to compensate for the landlord’s perceived risk. This demonstrates your commitment to the lease and helps mitigate their concerns.

- Build a Relationship: A personal connection with the landlord can sometimes sway their decision. Meet with them in person, be respectful, and express your genuine desire to rent the property.

Remember, even if you don’t secure a complete waiver of the cosigner requirement, a successful negotiation might lead to more lenient terms or alternative arrangements. By demonstrating your financial responsibility and building a strong case, you increase your chances of renting the apartment without a cosigner.

Presenting Yourself as a Responsible Tenant

Without a cosigner, you’ll need to impress potential landlords with your responsibility and reliability. Demonstrate your ability to pay rent on time and take good care of the property. A well-organized, well-written rental application is a must. Ensure that your application is free of errors and that all information is accurate and up-to-date. This shows attention to detail and a commitment to being organized.

To further emphasize your responsibility, provide positive references from previous landlords. Be prepared to explain any gaps in your rental history or any negative marks on your credit report. Landlords may also ask for proof of income, so have pay stubs or bank statements ready.

While landlords want tenants who can pay rent, they also want tenants who will treat their property with respect. Show your commitment to responsible living by expressing your understanding of lease terms and outlining your plans to maintain the apartment in good condition.

Highlighting Your Stable Employment and Income

Landlords want to see that you have a stable income to afford rent. They want to be confident that you’ll be able to pay your rent on time, every month. If you don’t have a long rental history, you can highlight other aspects of your financial situation that demonstrate your stability.

If you’re employed full-time, provide a letter of employment from your employer that details your salary and how long you’ve been working there. If you’re self-employed, provide your tax returns for the past few years to demonstrate your income. If you’re a student, provide a letter of financial aid from your university.

You can also provide bank statements to show the landlord that you have enough money saved to cover rent and other expenses. You can also mention any savings accounts or investments you have. The more evidence you can provide of your stable income, the more likely a landlord will be to approve your application.

Using a Rental Resume to Showcase Your Qualifications

Landlords are increasingly looking for ways to assess the reliability of prospective tenants beyond just their credit score. A rental resume can be a valuable tool to help you stand out and prove your trustworthiness, especially if you’re applying for an apartment without a cosigner. This document allows you to showcase your history as a responsible renter, demonstrating your financial stability and commitment to upholding lease agreements.

Think of your rental resume as a tailored, visually appealing summary of your rental history, including details like:

- Previous rental addresses: List your past rental addresses, including the dates you lived there, and the type of property (house, apartment, etc.)

- Landlord contact information: Include phone numbers and email addresses of previous landlords. This allows the prospective landlord to verify your rental history.

- Positive feedback: If you received positive feedback from past landlords, such as a recommendation letter or an email praising your tenancy, include it. This provides concrete evidence of your good rental history.

- Proof of income: Include pay stubs, bank statements, or other documents that demonstrate your consistent income. This assures the landlord of your ability to afford the rent.

- Positive financial history: Highlight any positive financial milestones, such as successfully paying off a loan or building a strong credit score.

A well-crafted rental resume can go a long way in convincing a landlord that you’re a responsible and reliable tenant, even without a cosigner. It allows you to control the narrative and present yourself in the best possible light.

Exploring Alternative Housing Options

If you’re struggling to find an apartment without a cosigner, it’s time to explore alternative housing options. While traditional apartments might seem out of reach, there are other housing solutions that can offer you a safe and comfortable place to live.

Here are a few options to consider:

- Roommates: Sharing a house or apartment with roommates is a cost-effective way to reduce your housing expenses. You can find roommates through online platforms or by asking your network.

- Subletting: Subletting involves renting a portion of someone’s already-leased apartment or house. It’s a good option for shorter-term stays or if you’re looking for a more affordable living arrangement.

- Micro-Apartments: Micro-apartments are small, compact living spaces that are gaining popularity in urban areas. They offer affordability and a unique living experience.

- Temporary Housing: If you need a place to stay for a short period, consider temporary housing options like short-term rentals, furnished apartments, or hostels. These can be a good solution while you search for a permanent place.

Remember to research the pros and cons of each option and choose the one that best suits your needs and budget.

Understanding Your Rights as a Tenant

Being a tenant comes with certain rights. It’s essential to understand these rights before signing a lease agreement, especially if you’re renting without a cosigner. Here are some key rights to keep in mind:

Right to a Safe and Habitable Living Space: Your landlord has a legal responsibility to provide a safe and habitable living environment. This includes basic necessities like running water, heat, electricity, and a structurally sound building. If any of these essential services are compromised, you may have the right to withhold rent or take legal action.

Right to Privacy: Landlords generally cannot enter your apartment without a valid reason and proper notice. They need to respect your privacy and can’t enter without your permission unless there’s an emergency, a court order, or to perform necessary repairs.

Right to Quiet Enjoyment: You have the right to enjoy your living space without unreasonable interference from your landlord or other tenants. Excessive noise, harassment, or disruptions can be considered violations of your right to quiet enjoyment.

Right to Security Deposit Return: Upon moving out, you are entitled to receive your security deposit back, minus deductions for any damages beyond normal wear and tear. Be sure to review the lease agreement for the specific terms regarding security deposit returns.

Right to Fair Treatment: Landlords are obligated to treat all tenants fairly and without discrimination based on race, religion, national origin, or other protected characteristics. If you experience unfair treatment, you may have legal recourse.

It’s crucial to familiarize yourself with your tenant rights in your state or city, as laws can vary. You can find resources from legal aid organizations or your local housing authority.