Are you tired of throwing money away on rent every month? Are you dreaming of owning your own home but unsure if it’s the right financial decision? The age-old debate of renting vs buying is a complex one, with a myriad of factors to consider. This article will break down the pros and cons of both options, helping you determine which path is best for your current situation and long-term financial goals. Whether you’re a first-time homebuyer or a seasoned renter, this guide will provide valuable insights to make a well-informed decision.

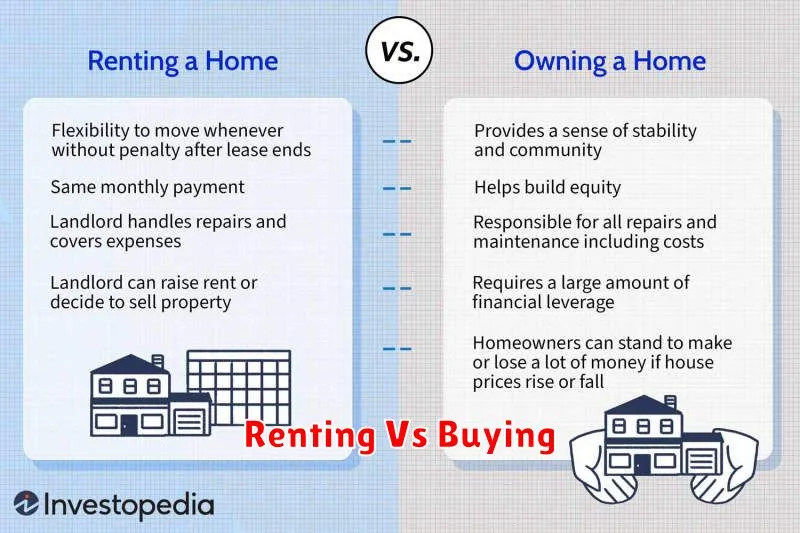

Weighing the Advantages of Renting

While buying a home is often considered the “American Dream,” renting offers its own set of compelling advantages. For many individuals and families, renting provides a flexible, affordable, and low-maintenance lifestyle that can be incredibly appealing.

One of the most significant advantages of renting is financial flexibility. Unlike homeowners, renters are not tied down by a mortgage and the associated costs. This means they have more disposable income to pursue other financial goals, such as saving for retirement, investing, or paying down debt. Renters also enjoy lower upfront costs, as they don’t need to put down a large down payment or cover closing costs. This can be particularly beneficial for those with limited savings or who are new to the workforce.

Renters also benefit from reduced responsibility. They don’t have to worry about maintenance and repairs, which can be costly and time-consuming for homeowners. Landlords are typically responsible for major repairs and upkeep, allowing renters to focus on other aspects of their lives. Additionally, renting provides greater mobility. When a renter’s lease ends, they are free to move to a new location without the hassle and expense of selling a property. This flexibility is particularly valuable for individuals with unpredictable career paths or those who enjoy exploring different neighborhoods.

Finally, renting often comes with access to amenities that might not be available or affordable for homeowners, such as swimming pools, fitness centers, or on-site security. These amenities can enhance the overall quality of life for renters and create a sense of community.

Exploring the Benefits of Homeownership

Owning a home is a significant milestone for many individuals and families, offering a range of financial and lifestyle benefits. While the decision to buy or rent depends on personal circumstances, exploring the advantages of homeownership can provide valuable insights.

One of the most significant benefits of homeownership is building equity. With each mortgage payment, you gradually pay down the principal, increasing your ownership stake in the property. Over time, this accumulated equity can serve as a valuable asset, providing financial security and potential for future investments.

Another key advantage is stability and control. As a homeowner, you have the freedom to customize your living space, make improvements, and enjoy the peace of mind that comes with knowing your home is your own. This freedom can be especially appealing to families with children, as it allows them to create a lasting and personalized environment for their growing needs.

Homeownership also offers potential tax benefits. Homeowners can deduct mortgage interest and property taxes from their federal income taxes, resulting in significant savings. This can further enhance the financial attractiveness of buying a home.

Moreover, owning a home can contribute to building wealth. The appreciation of property values over time can provide substantial financial returns. While market fluctuations exist, real estate historically has been a reliable investment, contributing to overall financial stability and growth.

Beyond financial benefits, homeownership often fosters a sense of community and pride. Being rooted in a specific neighborhood can create a sense of belonging and strengthen relationships with neighbors. Many homeowners also take pride in maintaining and improving their homes, contributing to the overall aesthetic and value of their community.

In conclusion, exploring the benefits of homeownership reveals a compelling set of advantages. From building equity and financial stability to enjoying customization and potential tax benefits, homeownership offers a path to financial security, lifestyle fulfillment, and community engagement. However, it is essential to carefully weigh the responsibilities and financial considerations before making a decision that aligns with your individual circumstances and goals.

Financial Implications of Renting vs. Buying

The decision of whether to rent or buy a home is a significant one, with major financial implications. Understanding these implications can help you make an informed decision that aligns with your financial goals and circumstances.

Renting offers flexibility and lower upfront costs. You typically pay a security deposit and first month’s rent, avoiding the hefty down payment and closing costs associated with buying. Rent payments are also generally fixed, providing predictable expenses. However, rent can increase over time, and you don’t build equity in the property.

Buying, on the other hand, allows you to build equity in your home. As you pay down your mortgage, you gain ownership of the property. This can be a significant investment, especially if property values appreciate. However, buying involves substantial upfront costs, including a down payment, closing costs, and ongoing expenses like property taxes and maintenance. You also take on the responsibility of homeownership, which includes repairs and upkeep.

Financial considerations when choosing between renting and buying include your current financial situation, income stability, and long-term financial goals. Consider factors like your ability to save for a down payment, your monthly budget, and your anticipated timeline for homeownership. It’s wise to consult with a financial advisor to assess your individual circumstances and explore options that best fit your financial objectives.

The Flexibility of Renting

One of the biggest advantages of renting is the flexibility it offers. Unlike buying, renting allows you to move more easily and without the hassle of selling a property. This is particularly beneficial for those who are unsure of their long-term plans, such as young professionals, those pursuing higher education, or those who enjoy traveling and exploring different areas.

Furthermore, renting provides flexibility in terms of lifestyle. You can move to a smaller or larger unit depending on your needs, and you are not tied down to a specific location for a set period of time. This can be particularly appealing for individuals whose careers or personal situations may change frequently.

Another key aspect of renting is the financial flexibility. You are not responsible for major repairs or maintenance, which can save you a significant amount of money. This allows you to allocate your finances towards other goals, such as investments, travel, or building an emergency fund.

Long-Term Investment: Buying a Property

Owning a property is often seen as a long-term investment, and for good reason. Property values generally appreciate over time, meaning your investment could grow significantly in the future. This appreciation can be a source of wealth building, especially if you plan to sell the property in the future. You will also benefit from equity building, which is the portion of the property’s value that you own after making payments.

Beyond financial benefits, owning a property offers you stability and control. You have the freedom to customize and renovate your space to your liking, unlike renting where you are often limited by lease agreements. You are also not subject to the whims of landlords or potential rent increases. This provides peace of mind and a sense of security.

However, buying a property is a major financial commitment that requires careful consideration. It involves a substantial down payment, ongoing mortgage payments, property taxes, and potential maintenance costs. You need to factor in these expenses and ensure you can comfortably afford them. You should also assess your long-term plans, as selling a property can be time-consuming and costly, especially in a fluctuating market.

Maintenance and Repairs: Renting vs. Owning

One of the biggest differences between renting and owning a home is the responsibility for maintenance and repairs. When you rent, your landlord is typically responsible for fixing any major problems, such as a leaky roof or a broken furnace. However, you may be responsible for minor repairs, such as changing lightbulbs or unclogging drains. This is often outlined in your lease agreement.

When you own a home, you are responsible for all repairs, no matter how big or small. This can be a major financial burden, especially if something unexpected happens, like a burst pipe or a tree falling on your roof. It’s important to factor in the cost of maintenance and repairs when deciding whether to rent or buy.

Here’s a breakdown of the pros and cons of each:

Renting

Pros

- Less financial responsibility: You don’t have to worry about the cost of major repairs, as your landlord is usually responsible.

- More flexibility: You can move more easily if you need to, without having to sell your home.

Cons

Owning

Pros

Cons

Building Equity Through Homeownership

One of the biggest advantages of buying a home is the ability to build equity. Equity is the difference between the current market value of your home and the amount you still owe on your mortgage. As you pay down your mortgage, you’re essentially building ownership of your home. This equity can be a valuable asset, as it can be used as collateral for loans, or it can be tapped into for other financial needs.

Renters, on the other hand, are essentially paying for the right to live in a property for a set period of time. Their rent payments go directly to the landlord, and they don’t build any equity in the property. This means that they don’t have any ownership stake in the property, and they won’t be able to reap any financial benefits from its appreciation.

Building equity through homeownership can be a powerful tool for wealth creation. As your home appreciates in value, so does your equity. This can be a significant financial advantage, especially over the long term. It’s important to note, however, that home values can also fluctuate, so there’s always some risk involved. But for many people, the potential benefits of building equity far outweigh the risks.

The Rental Market and Its Fluctuations

The rental market is a dynamic entity, constantly shifting with the ebb and flow of economic and social trends. Understanding the fluctuations in the rental market is crucial for both potential renters and landlords. Here are some key factors that contribute to these variations:

Economic Conditions: A robust economy typically translates to higher demand for rental properties, driving up rents. Conversely, economic downturns can lead to reduced demand and lower rents.

Interest Rates: When interest rates rise, mortgage costs become more expensive, potentially leading some to opt for renting instead of buying. This can increase competition for rental properties and drive up rents.

Local Market Conditions: The rental market in a specific region can be influenced by factors such as population growth, job opportunities, and the availability of housing. For example, a city experiencing rapid population growth may see a surge in rental demand and higher rents.

Inventory Levels: The availability of rental properties plays a significant role in determining rent prices. A shortage of available units can lead to higher rents due to increased competition. Conversely, a surplus of rental units can drive rents down as landlords compete for tenants.

Seasonal Trends: Rental demand and prices can fluctuate seasonally. For example, in areas with a strong tourism industry, rents may be higher during peak tourist season.

It’s important to note that these fluctuations can vary widely depending on the specific location and time period. Staying informed about the current market trends and analyzing factors like those listed above can help both renters and landlords make informed decisions about their housing choices.

Property Value Appreciation: A Homeowner’s Perspective

One of the biggest draws to homeownership is the potential for property value appreciation. This means that your home’s worth increases over time, potentially generating significant financial gains when you decide to sell. However, it’s crucial to understand that property value appreciation is not a guaranteed return on investment.

Factors like market conditions, local economic growth, and interest rates can influence property values. While some areas might experience consistent appreciation, others might face stagnation or even depreciation. It’s essential to conduct thorough research about the local market and consult with real estate professionals before making a purchase.

Furthermore, owning a home comes with ongoing expenses, including property taxes, maintenance, and potential repairs. These costs can chip away at any potential appreciation gains. It’s essential to factor in these expenses when calculating your potential return on investment. Additionally, it’s important to consider the opportunity cost of the money tied up in your home, as it could be invested elsewhere for potential growth.

Property value appreciation can be a significant financial advantage for homeowners, but it’s not a guaranteed outcome. Careful planning and research are essential to make informed decisions about your finances and housing choices.

The Commitment of a Mortgage

One of the biggest differences between renting and buying is the commitment involved. When you rent, you have a lease that typically lasts for a year or more. At the end of the lease, you have the option to renew, move out, or negotiate a new lease. However, when you buy a home, you are making a much larger commitment. You are taking on a mortgage, which is a loan that you will need to repay over a period of 15 to 30 years.

A mortgage requires you to make monthly payments, which can be a significant financial burden. You also need to be prepared for unexpected maintenance costs. If your roof leaks or your furnace breaks down, you will need to pay for repairs. In addition, you will need to pay property taxes and homeowners insurance. However, buying a home also comes with a lot of benefits. You have the opportunity to build equity in your home, which means that you are building wealth over time. You also have the freedom to make changes to your home, such as painting, remodeling, or landscaping. Ultimately, the decision of whether to rent or buy is a personal one that depends on your individual circumstances and priorities.

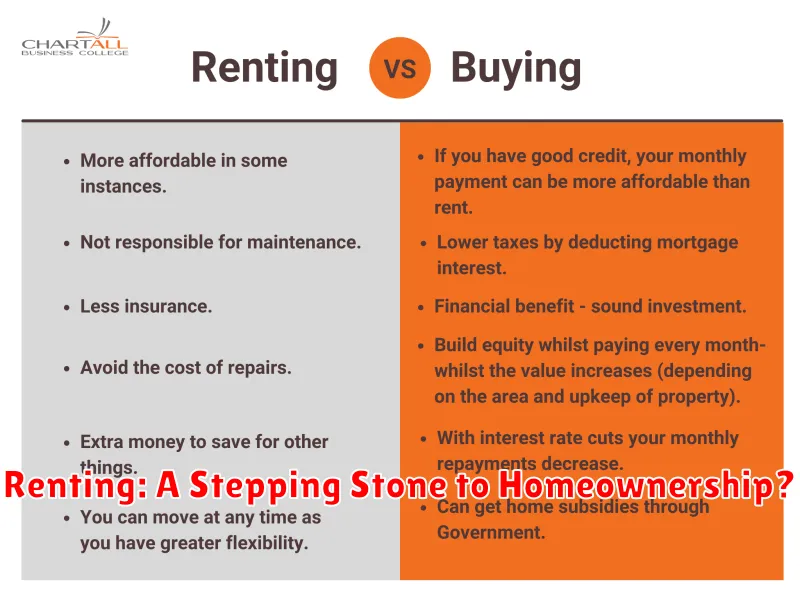

Renting: A Stepping Stone to Homeownership?

While renting might seem like a temporary solution, it can actually be a strategic stepping stone towards homeownership. It allows you to establish credit history, which is essential for securing a mortgage. By consistently paying rent on time, you demonstrate financial responsibility, building a positive credit score. Moreover, renting provides an opportunity to save for a down payment and learn about your lifestyle preferences. Observing different neighborhoods and dwelling types can help you identify the ideal home for your future.

Renting also offers flexibility. Unlike homeowners, you are not tied down to a specific location. This freedom allows you to explore different areas, experience various lifestyles, and potentially discover a neighborhood that aligns with your long-term goals. Additionally, renting eliminates the burden of maintenance and repair costs, freeing up your financial resources for saving towards homeownership.

However, renting does come with its drawbacks. The biggest disadvantage is that you are essentially paying for someone else’s equity. While you may be contributing to your landlord’s wealth, you are not building your own. Furthermore, rent increases can be unpredictable, leading to fluctuations in your monthly expenses. Additionally, renting often comes with limitations on customization and personalizing your living space. You may be restricted in making changes to the property, which can be frustrating for those seeking a sense of ownership.

Ultimately, the decision to rent or buy depends on your individual circumstances and goals. If you are looking to build credit, save for a down payment, and gain valuable experience before making a significant investment in real estate, renting can be a valuable stepping stone towards homeownership. However, if you prioritize building equity, personalizing your living space, and long-term stability, buying may be a more suitable option. Weighing the pros and cons carefully will help you make the best choice for your financial and lifestyle needs.

Hidden Costs of Owning a Home

While buying a home offers the potential for long-term financial benefits, it’s essential to consider the hidden costs that can significantly impact your budget. These expenses often go unnoticed during the initial purchase phase but can add up over time.

Maintenance and Repairs: Homeownership comes with the responsibility of maintaining and repairing your property. From routine tasks like landscaping and plumbing to unexpected repairs like a leaky roof or broken appliances, these expenses can be substantial and unpredictable.

Property Taxes: Annual property taxes can vary significantly depending on your location and the assessed value of your home. While you can deduct these taxes on your federal income tax return, they represent a recurring expense that can add up.

Homeowners Insurance: Unlike renter’s insurance, which covers your personal belongings, homeowners insurance protects your property against damage or loss. Premiums can fluctuate based on factors such as location, coverage, and the age of your home.

Utilities: Homeowners are responsible for paying for utilities, such as electricity, gas, water, and trash removal. These costs can vary depending on the size of your home, your energy usage, and the climate you live in.

HOA Fees: If you live in a homeowners’ association (HOA), you will be required to pay monthly fees for amenities like community pools, gyms, and landscaping. These fees can range from a few hundred to thousands of dollars per year.

Understanding these hidden costs is essential when comparing the pros and cons of renting versus buying. While homeownership can offer long-term financial benefits, it’s crucial to factor in these additional expenses to ensure you make an informed decision that aligns with your financial goals.

Tax Benefits for Homeowners

Owning a home comes with a range of financial benefits, including tax advantages. Here are some of the key tax deductions available to homeowners:

Mortgage Interest Deduction: This is perhaps the most significant tax benefit for homeowners. You can deduct the interest paid on your mortgage, which can result in substantial savings on your tax bill. The amount you can deduct is subject to certain limitations, such as the amount of your mortgage and the number of years you have owned the property.

Property Taxes Deduction: Homeowners can deduct the property taxes they pay on their primary residence. This includes real estate taxes, but not personal property taxes (like taxes on furniture). This deduction can significantly reduce your taxable income.

Home Improvement Deductions: Certain home improvements, like energy-efficient upgrades or accessibility modifications, can qualify for tax deductions. These deductions can help offset the cost of these improvements and encourage homeowners to make their homes more energy-efficient and accessible.

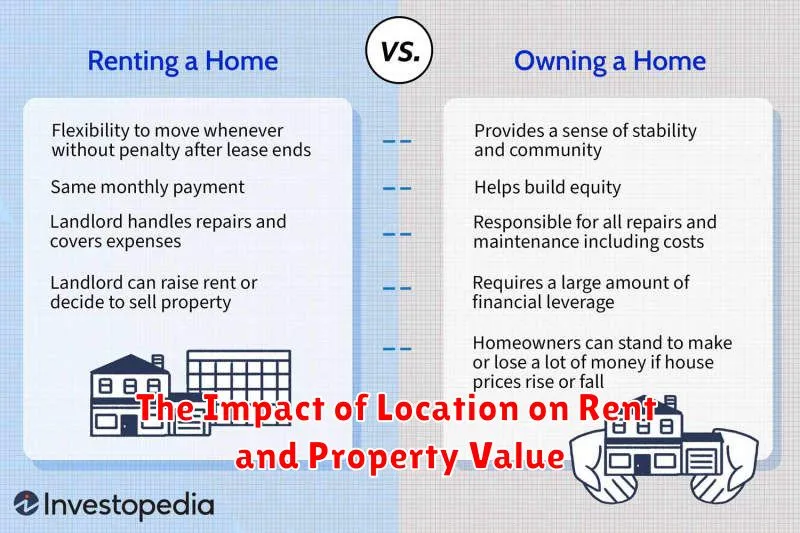

The Impact of Location on Rent and Property Value

Location is a key factor that significantly influences both rent and property values. Neighborhood amenities, such as parks, schools, and public transportation, play a vital role in determining the desirability of a location. Proximity to employment centers, entertainment options, and shopping districts can also impact rent and property values. The closer a property is to these amenities and conveniences, the higher the demand, resulting in higher rent and property values.

Crime rates and overall safety are also crucial factors to consider. Areas with higher crime rates tend to have lower property values and rental rates. Conversely, neighborhoods with low crime rates and a reputation for safety often command premium prices.

Property taxes and local regulations can also have an impact on location. Areas with higher property taxes or strict zoning regulations may result in lower property values. However, it’s important to note that higher property taxes may also indicate a well-maintained community with strong infrastructure.

In summary, location plays a pivotal role in determining rent and property values. Factors such as amenities, proximity to employment centers, safety, crime rates, property taxes, and local regulations all contribute to the overall desirability of a location, ultimately impacting the cost of renting or buying a property.