Are you a renter who thinks that landlord’s insurance covers you? Think again! While your landlord’s insurance protects the building itself, it doesn’t cover your personal belongings. This is where renters insurance comes in. This affordable insurance policy provides coverage for your personal property, liability, and even additional living expenses if your apartment becomes uninhabitable. Don’t risk losing everything you own – learn why renters insurance is essential and how it can safeguard your financial well-being.

What is Renters Insurance?

Renters insurance is a type of insurance policy that protects your personal belongings from damage or loss due to various perils such as fire, theft, vandalism, or natural disasters. It also provides liability coverage for injuries or damages that occur to others on your property.

Think of it as a safety net for your valuables. It helps you recover financially from unexpected events, ensuring that you’re not left with significant out-of-pocket expenses.

In essence, renters insurance provides financial protection for your possessions and personal liability. It’s a crucial investment that safeguards your financial well-being and peace of mind.

What Does Renters Insurance Cover?

Renters insurance is a vital protection for anyone who rents a home or apartment. It provides coverage for your personal belongings in case of theft, fire, or other covered events. Here’s a breakdown of what renters insurance typically covers:

Personal Property: This is the most significant part of your coverage. Renters insurance protects your belongings, such as furniture, electronics, clothing, jewelry, and more, against damage or loss due to covered perils.

Liability Coverage: This portion covers you if someone gets injured on your property or if you accidentally damage someone else’s property. For example, if a guest trips and falls in your apartment, liability coverage helps pay for their medical bills and legal costs.

Additional Living Expenses: If your home becomes uninhabitable due to a covered event, renters insurance can reimburse you for temporary housing, meals, and other essential expenses while your apartment is being repaired.

Other Coverage: Some renters insurance policies offer additional protection for specific situations, like:

- Personal Liability: For accidents outside your home.

- Medical Payments: To cover medical expenses for guests injured on your property.

- Identity Theft: For expenses related to identity theft.

It’s important to note that renters insurance typically doesn’t cover damage caused by natural disasters like earthquakes or floods, unless you purchase additional coverage. Additionally, it’s crucial to understand the limits of your coverage and to maintain accurate inventory of your belongings.

How Much Does Renters Insurance Cost?

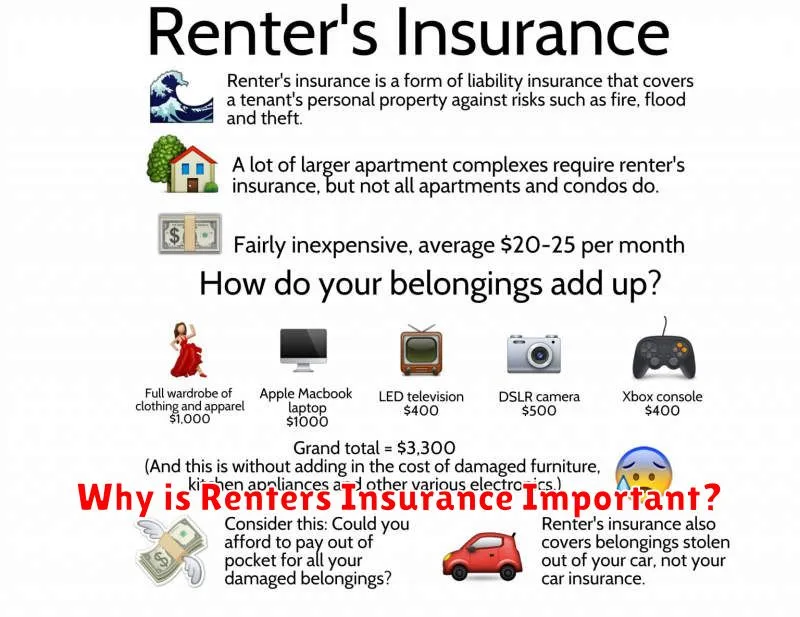

The cost of renters insurance can vary depending on a number of factors, including your location, the value of your belongings, and the amount of coverage you choose. However, in general, you can expect to pay between $15 and $30 per month for renters insurance.

Here are some of the factors that can affect the cost of renters insurance:

- Location: Renters insurance is more expensive in areas with a higher risk of natural disasters, such as earthquakes or hurricanes.

- Value of your belongings: The more valuable your belongings are, the more you will pay for renters insurance. You will need to make sure that your policy provides enough coverage to replace all of your belongings in the event of a loss.

- Amount of coverage you choose: The more coverage you choose, the more you will pay for renters insurance. You can choose different levels of coverage for your belongings and liability.

- Your credit score: Some insurance companies use your credit score to determine your premiums. A higher credit score may result in lower premiums.

If you are considering getting renters insurance, it is important to get quotes from multiple insurance companies to compare prices. You can also ask your landlord or property manager if they have any recommendations.

Common Misconceptions about Renters Insurance

Renters insurance is an essential safety net for anyone who rents a property. It provides financial protection against unexpected events like theft, fire, or natural disasters. However, there are some common misconceptions surrounding renters insurance that prevent people from taking advantage of its benefits.

One common misconception is that renters insurance is too expensive. In reality, it is relatively affordable, with policies often starting for less than $20 per month. The cost of renters insurance is significantly less than the potential financial burden of replacing lost or damaged belongings.

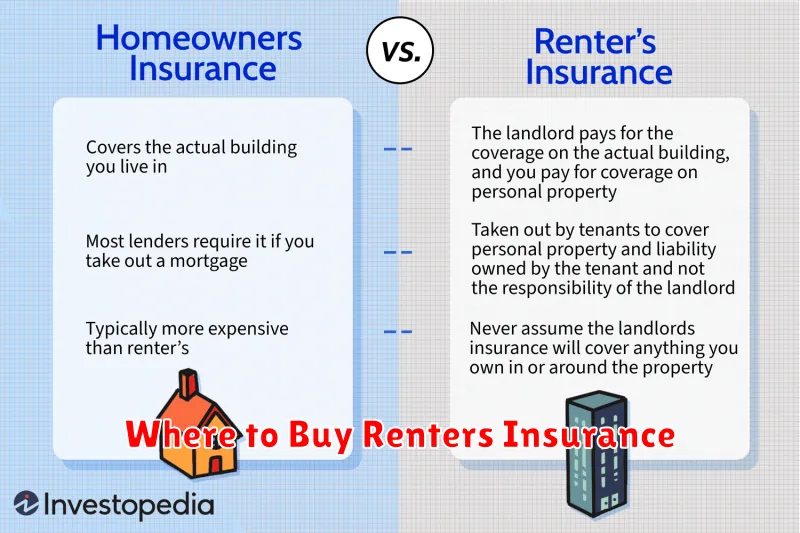

Another misconception is that landlord’s insurance covers your personal belongings. While your landlord’s insurance protects the building itself, it does not cover your personal belongings. If your belongings are damaged or stolen, you will be responsible for replacing them, unless you have renters insurance.

Many people also believe that renters insurance is only for high-value possessions. This is not true. Even if you have modest belongings, renters insurance can provide valuable protection. It covers not only the cost of replacing your belongings but also additional living expenses if you are displaced from your home due to a covered event.

How to Choose the Right Renters Insurance Policy

Choosing the right renters insurance policy can feel overwhelming. It’s essential to select a policy that provides adequate coverage for your belongings at a price you can afford. Here are some key factors to consider:

1. Coverage Limits: Determine the value of your possessions. Consider the cost to replace your belongings in today’s market, not just what you paid for them. Choose coverage limits that align with this value.

2. Deductible: This is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible generally results in lower premiums. Weigh the cost of a higher deductible against the potential savings.

3. Personal Liability Coverage: This protects you if someone is injured on your property. It’s vital, even if you’re renting. Ensure sufficient coverage to handle potential claims.

4. Additional Coverages: Consider add-ons like flood insurance, earthquake coverage, or identity theft protection. These may be essential depending on your location and needs.

5. Insurance Company Reputation: Research companies for their financial stability, claims handling process, and customer reviews. Choose a reputable company with a track record of fair and efficient claims processing.

6. Compare Quotes: Get quotes from multiple insurers to compare coverage options and prices. Don’t just go with the cheapest option, as it might not offer the protection you need.

By carefully considering these factors, you can choose a renters insurance policy that provides the right level of coverage for your belongings and peace of mind.

Where to Buy Renters Insurance

Finding the right renters insurance can feel overwhelming, but it doesn’t have to be. You have several options for where to buy renters insurance, each with its own advantages and disadvantages.

The easiest way to get renters insurance is through your current homeowners insurance provider. Many homeowners insurance companies offer renters insurance policies as well. This can be convenient, as you can manage both policies under one roof. However, it may not always be the cheapest option.

Another option is to buy renters insurance directly from a standalone insurance company. This gives you more flexibility to compare prices and coverage options. There are several well-known insurance companies like State Farm, Allstate, and Liberty Mutual that offer renters insurance. You can get quotes online or by phone.

Finally, you can also get renters insurance through an online insurance marketplace. These platforms compare quotes from multiple insurers, making it easy to find the best deal. Some popular online marketplaces include Lemonade, Policygenius, and The Zebra. These platforms often have user-friendly interfaces and can save you time and effort.

When to Buy Renters Insurance

Renters insurance is a vital safety net for anyone renting a property. It protects your belongings in case of unexpected events like theft, fire, or natural disasters. While you might think you can afford to skip it, it’s crucial to understand that your landlord’s insurance policy doesn’t cover your personal belongings. It’s crucial to remember that your landlord’s insurance policy only protects the building itself, not your personal possessions. Therefore, acquiring renters insurance is the only way to safeguard your valuables against potential losses.

So, when is the best time to buy renters insurance? Ideally, you should get it as soon as you sign your lease. This way, you’ll be covered from the moment you move in. However, it’s never too late to get renters insurance. Even if you’ve been living in your apartment for a while, it’s still a good idea to get coverage. Waiting until an incident occurs might leave you facing a financial burden that could have been avoided.

You should also consider getting renters insurance if you have any of the following:

- Valuable belongings: If you have expensive electronics, jewelry, or other high-value items, renters insurance can protect you from financial ruin in the event of damage or loss.

- Limited financial resources: If you have a low credit score or limited financial resources, renters insurance can help you recover from a major loss without jeopardizing your financial well-being.

- Concerns about liability: Renters insurance also includes liability coverage, which can protect you if someone is injured on your property. This is especially important if you have pets or frequently host guests.

Why is Renters Insurance Important?

Renters insurance is a vital safety net for anyone who rents, offering protection against financial hardship due to unforeseen events. It’s not just about covering your belongings; it’s about safeguarding your peace of mind and ensuring you can rebuild your life after a disaster.

Think about it: what would you do if a fire, theft, or natural disaster destroyed your personal belongings? Without renters insurance, you would be responsible for replacing everything yourself. This could leave you in a difficult financial situation, struggling to afford essential items like furniture, clothing, electronics, and even your personal documents.

Renters insurance also provides crucial liability coverage. If someone gets injured in your apartment, you could be held responsible for their medical bills and legal fees. This coverage protects you from financial ruin in such situations.

While you may be tempted to skip renters insurance, it’s a small investment that can provide significant peace of mind. The cost of a policy is typically very affordable, and the potential benefits far outweigh the cost. Don’t wait until it’s too late – protect yourself and your belongings with renters insurance.

Do I Need Renters Insurance if My Landlord Has Insurance?

While your landlord’s insurance policy covers the building itself, it doesn’t cover your personal belongings. Your landlord’s insurance is designed to protect the structure of the building from damage, not the things inside. This is where renters insurance comes in.

Renters insurance provides financial protection for your personal property, including furniture, electronics, clothing, and other valuables. It also offers liability coverage, which protects you from lawsuits if someone is injured in your apartment.

Even if your landlord has insurance, you still need renters insurance to protect your own belongings. Imagine a fire, theft, or other disaster that destroys your belongings. Without renters insurance, you’d be responsible for replacing everything out of pocket.

The cost of renters insurance is relatively low, and it can provide significant financial protection in the event of a disaster. It’s a wise investment for any renter, regardless of whether their landlord has insurance.

What are the Different Types of Renters Insurance Coverage?

Renters insurance is designed to protect your personal property from damage or loss. It can also provide liability coverage in case someone is injured on your property. There are several different types of coverage available, and the specific coverage you need will depend on your individual circumstances.

The most common types of renters insurance coverage include:

- Personal property coverage: This covers your belongings, such as furniture, electronics, clothing, and jewelry, in case they are damaged or stolen. You can usually choose to cover your belongings at either actual cash value (ACV) or replacement cost value (RCV). ACV pays you the depreciated value of your belongings while RCV pays you the cost to replace them with new ones.

- Liability coverage: This protects you financially if someone is injured on your property or if you accidentally damage someone else’s property.

- Additional living expenses coverage: This helps cover the cost of living elsewhere if your apartment is uninhabitable due to a covered event, such as a fire or flood. This could include expenses such as hotel stays, restaurant meals, and temporary housing.

- Personal injury coverage: This protects you from claims of slander, libel, or other personal injury, which can often be included under your liability coverage.

- Medical payments coverage: This helps cover the medical expenses of someone who is injured on your property, regardless of who is at fault.

It is important to carefully review your renters insurance policy and understand what is and is not covered. Talk to your insurance agent to determine what types of coverage are right for your needs.