Finding the perfect apartment as a freelancer can be challenging. You need a space that’s both functional and inspiring, but you also need to consider your budget and lifestyle. You may be worried about finding a place that allows home offices or that is pet-friendly, but don’t fret! With a little planning and research, you can find the ideal apartment for your freelance life. This guide will cover essential tips for renting an apartment as a freelancer, from choosing the right location to negotiating a lease.

Understanding Landlord Requirements

As a freelancer, you might face unique challenges when renting an apartment. Landlords often have specific requirements for tenants, and understanding these requirements is crucial to finding a place that suits your needs and financial situation. Here are some key things to consider:

Proof of Income: Unlike traditional employees, freelancers may not have a consistent pay stub. Landlords might require you to provide alternative documents like bank statements, tax returns, or freelance contracts to demonstrate your income. Being prepared with these documents will streamline the application process.

Credit History: Your credit score plays a significant role in the rental process. Landlords often check your credit history to assess your financial responsibility. If you have a low credit score, you might need to provide a guarantor or offer a larger security deposit to secure the lease.

Employment Verification: Some landlords require you to provide employment verification, even if you are self-employed. You can satisfy this requirement by providing a letter stating your freelance business details and income. It’s important to be open and transparent with your employment status to build a trusting relationship with your landlord.

Rent Payment Schedule: Freelancers often have variable income, so discussing a suitable rent payment schedule with your landlord is essential. Some landlords might be open to flexible arrangements, such as allowing you to pay in installments or on a schedule that aligns with your project deadlines.

Home Office Policy: If you work from home, ensure the lease agreement clearly outlines the landlord’s policy regarding home offices. Some landlords might have restrictions on running a business from the rented property, including noise limitations or restrictions on clientele access.

By understanding these landlord requirements, you can navigate the apartment rental process as a freelancer with confidence. Be prepared to provide the necessary documentation, be open about your work situation, and communicate effectively with your landlord to establish a mutually beneficial arrangement.

Demonstrating Income Stability

Landlords want to see that you can reliably pay rent, and as a freelancer, this can be a challenge. They may ask for proof of income, such as bank statements or tax returns. If you can’t provide consistent income for the past 12 months, you can consider showing them a letter of recommendation from a past landlord or client. Providing a contract or work order to show you have a steady stream of work will help you show that you’re financially stable.

Another option is to offer a larger security deposit or a longer lease term to assure them that you’re a reliable tenant. You may also be able to use a guarantor, like a parent or friend, to demonstrate financial stability.

Providing Financial Documentation

Landlords often require proof of income, especially for freelancers. They want to ensure you can afford rent. This might include bank statements, tax returns, or invoices.

Prepare a detailed financial history to demonstrate your steady income stream. Organize bank statements, invoices, and tax records to present a clear picture of your finances.

Consider a letter of explanation to clarify the nature of your freelance income. A letter detailing your work history, client base, and average earnings can bolster your application.

Communicate with your landlord. Be upfront about your freelance status and your ability to pay rent. Open communication and transparency can go a long way in securing an apartment.

Building a Strong Rental History

As a freelancer, you may not have a traditional employment history to show landlords. However, you can build a strong rental history that will make you an attractive tenant. Here are some tips:

Be a reliable tenant. Pay your rent on time, every time. Avoid late payments and communicate any potential issues promptly. Landlords appreciate tenants who are responsible and communicative.

Maintain the property. Keep the property clean and in good condition. Treat the property with respect and avoid damage. When you leave, ensure the property is in good condition, ready for the next tenant.

Build relationships with landlords. Develop a positive relationship with your landlord. Communicate effectively and be respectful. If you have a good rapport with your landlord, they will be more likely to recommend you to others.

Use a guarantor. If you don’t have a traditional employment history, you might need a guarantor to help you secure a rental. A guarantor is someone who agrees to be financially responsible for your rent if you fail to pay.

Consider short-term rentals. You can also consider short-term rentals like Airbnb or VRBO. These rentals require a shorter commitment and allow you to build a rental history over time.

By taking these steps, you can build a strong rental history as a freelancer, even without a traditional employment history. It is important to remember that your rental history is a crucial factor in getting approved for apartments, so take the time to establish a strong one.

Getting a Guarantor

One of the challenges you may face as a freelancer is getting approved for an apartment. Many landlords want to see a steady stream of income, and your freelance income may not be consistent enough to meet their requirements. If this is the case, a guarantor can help.

A guarantor is someone who agrees to be financially responsible for your rent if you default on your payments. This can be a family member, friend, or even a professional guarantor service. They’ll be responsible for your rent, which is a big commitment for them, so be sure to discuss it with them fully.

The process of getting a guarantor varies depending on the landlord, but you’ll usually need to provide their personal information and financial documents, such as their bank statements and tax returns. You’ll also need to have the guarantor sign a guarantor agreement, which outlines their responsibilities.

Keep in mind that having a guarantor doesn’t guarantee that you’ll be approved for an apartment. The landlord will still need to be satisfied with your credit history and other factors. However, it can be a valuable asset when applying for an apartment as a freelancer.

Negotiating Lease Terms

Negotiating lease terms can be a powerful tool for freelancers, as it allows you to customize your living situation to better fit your unique needs and work style. Here are some key points to consider when negotiating with your landlord:

Flexibility: Freelancers often have unpredictable schedules and may need the ability to work from home. Discuss the possibility of flexible lease terms, such as shorter lease periods, month-to-month agreements, or the ability to sublet if necessary. This flexibility can be beneficial for your peace of mind and workflow.

Home Office Considerations: If you plan to use your apartment for work, be clear about your needs. Negotiate for the inclusion of a dedicated workspace or consider asking for permission to make minor modifications to the space, such as installing a desk or shelving.

Utilities: Freelancers often work from home, and this can increase utility usage. Discuss the possibility of including utilities in the rent or negotiating a fair rate for additional usage.

Pet Policies: If you have pets, be upfront about their presence. While some landlords may be flexible about pet policies, others may have strict restrictions or require additional fees. Negotiate a clear understanding of pet policies and any associated costs.

Security Deposit: The amount of the security deposit can vary depending on the landlord and the property. Negotiate a reasonable amount that aligns with the market rate and the condition of the apartment.

Early Lease Termination: Freelancers may need to relocate unexpectedly due to work opportunities. Negotiate a clear clause regarding early termination, outlining potential penalties or the ability to break the lease under specific circumstances.

Remember to always be respectful and professional when negotiating lease terms. Approach these conversations with a clear understanding of your needs and the landlord’s perspective. Ultimately, a negotiated lease can create a more favorable and fulfilling living environment for you as a freelancer.

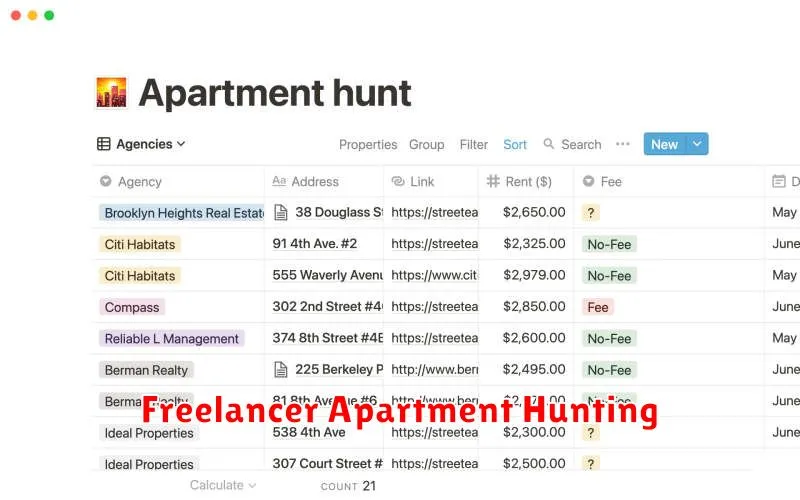

Finding Freelancer-Friendly Apartments

When searching for a new apartment as a freelancer, you’ll want to prioritize features that will help you work effectively from home. Here are some key things to look for:

Dedicated Workspace: Look for apartments with a separate room or designated area that you can transform into your home office. This will help you create a clear separation between work and personal life and make it easier to focus.

Good Internet Connectivity: Reliable and fast internet is crucial for freelancers. Inquire about the internet speed and provider available in the building or neighborhood. Consider areas with fiber optic connections for optimal performance.

Natural Light: Natural light can boost productivity and mood. Look for apartments with large windows or a balcony that allows ample sunlight to stream in. You can also consider the direction the apartment faces to maximize daylight hours.

Quiet Environment: Noise can be distracting when working from home. Choose a building or neighborhood that is relatively quiet and offers a peaceful atmosphere. You might also want to consider apartments on higher floors to minimize street noise.

Amenities: Some buildings offer amenities that can be beneficial to freelancers, such as co-working spaces, meeting rooms, or common areas that can serve as a place to network or take a break. These amenities can provide a sense of community and a change of scenery.

Highlighting Your Professionalism

When you’re a freelancer, you might not have the typical documentation that landlords often require. This is where showcasing your professionalism comes in. Don’t worry, it’s not about being stuffy, but about presenting yourself in a reliable and trustworthy way. Here’s how to do it:

1. Be prepared to share your work history: Instead of a traditional resume, create a document outlining your freelance work. Include client names (if permissible), project descriptions, and payment details to demonstrate your consistent income.

2. Offer a detailed financial plan: Landlords want to see that you can afford rent. Prepare a budget outlining your income sources, expenses, and how you’ll manage rent payments. Be clear and transparent.

3. Show a track record of responsibility: Provide references from past landlords or clients who can vouch for your reliability and ability to pay rent on time.

4. Leverage your online presence: If you have a professional website or social media profiles, showcase them. These platforms demonstrate your professionalism and dedication to your work.

By highlighting your professionalism, you’ll gain the trust of landlords and secure the apartment you desire. Remember, being a freelancer doesn’t mean you’re less reliable. It’s about showcasing your unique situation effectively.

Securing a Lease Agreement

When renting an apartment as a freelancer, securing a lease agreement can be tricky. Landlords might have concerns about your income stability due to the fluctuating nature of freelance work. To address these concerns, here are some tips:

Provide Proof of Income: While you might not have traditional pay stubs, you can present bank statements, invoices, and tax returns to demonstrate your financial capability. Offer a letter of explanation detailing your freelance work and income, highlighting your client base and average monthly earnings.

Offer a Security Deposit: Many landlords are more comfortable with a larger security deposit to mitigate potential risks. This provides them with financial assurance in case of damage or unpaid rent.

Negotiate Flexible Terms: Explore lease options with shorter terms or clauses that allow for early termination with reasonable notice. This flexibility can be appealing to landlords as it ensures a tenant isn’t locked into a long-term commitment if their freelance income fluctuates.

Be Transparent and Honest: Be upfront with landlords about your freelance status and income. Honesty builds trust and allows them to understand your situation better.

By demonstrating your financial responsibility and being communicative, you can increase your chances of securing a lease agreement as a freelancer.

Preparing for the Application Process

Renting as a freelancer comes with a unique set of challenges. Landlords often require proof of stable income, which can be tricky to demonstrate when your earnings fluctuate. However, with careful preparation, you can increase your chances of securing a great apartment.

Firstly, gather your documents. This includes your bank statements, tax returns, and client contracts. Having this information readily available will show landlords your financial stability. Consider creating a letter of explanation outlining your freelance work, including details about your typical earnings and past clients.

Next, explore your options. Some landlords may be hesitant to rent to freelancers, so be prepared to be flexible. Consider co-signing with a friend or family member who has a stable income. Research landlords who are known to be accommodating towards freelancers.

Lastly, be upfront and communicate effectively. When you contact potential landlords, be honest about your freelance status. Explain your situation and address any concerns they may have. This transparency can go a long way in building trust and demonstrating your commitment to being a responsible tenant.

Using a Rental Application Service

Rental application services can be a great way to streamline the process of finding and applying for apartments. They often provide tools for searching properties, scheduling tours, and submitting applications online. While these services can be helpful, it’s important to understand the potential advantages and disadvantages before using one.

One of the biggest advantages of using a rental application service is that it can save you a lot of time and hassle. Instead of contacting landlords individually, you can search for properties and submit applications all in one place. These services can also help you avoid scams by verifying the legitimacy of landlords and properties.

However, some rental application services charge fees for their services. It’s important to research and compare different services to find one that offers the features you need at a price you can afford. Be sure to read the terms of service carefully before signing up to understand what fees you might be charged.

Ultimately, whether or not to use a rental application service is a personal decision. Weighing the potential benefits against the costs can help you determine if it’s the right choice for you.

Building a Positive Relationship with Your Landlord

While you might think it’s all about the rent, maintaining a good relationship with your landlord is vital for a smooth and enjoyable renting experience, especially as a freelancer. They are your point of contact for any issues or repairs, and a good rapport can make all the difference in your overall living experience.

Communication is key. Be proactive and keep your landlord informed about any potential issues with your apartment. Respond to emails promptly and communicate respectfully. Remember, you are not alone in this. Your landlord is also invested in maintaining a positive relationship.

Be respectful of the property. Treat it with care and ensure you follow the terms of your lease agreement. Being mindful of noise levels, especially during working hours, can go a long way in building a positive relationship. You can also make a good impression by being prompt with your rent payments.

Don’t be afraid to reach out. If you have any questions or concerns about the property, don’t hesitate to contact your landlord. A clear and open line of communication helps address any issues before they escalate.

Building a positive relationship with your landlord will not only make your tenancy smoother but also contribute to a more enjoyable living environment. It’s a two-way street, and a little effort on your part can go a long way.

Paying Rent Consistently and On Time

As a freelancer, you might have irregular income. Therefore, it is important to manage your finances carefully and ensure that you can pay your rent on time. Here are a few tips to help you do so:

Create a budget and stick to it. Track your income and expenses, and allocate a portion of your earnings towards rent. This will help you ensure that you have enough money to cover your rent payments.

Set up automatic payments. If possible, automate your rent payments through online banking or a rent payment platform. This way, you won’t have to worry about remembering to pay your rent or missing a deadline.

Communicate with your landlord. If you are experiencing financial difficulties, reach out to your landlord and explain your situation. They may be willing to work with you to create a payment plan.

Build an emergency fund. Save up some money in case of unexpected expenses, such as a job loss or a medical emergency. This will give you a safety net and prevent you from falling behind on your rent.

Consider using a rent guarantor. If you have trouble qualifying for a lease due to a lack of steady income, you can consider using a rent guarantor. This is someone who agrees to cover your rent if you cannot afford it.

Protecting Your Rights as a Freelancer Tenant

As a freelancer, securing an apartment can be a unique challenge. You may face skepticism from landlords due to the perceived instability of your income. It’s essential to understand your rights and ensure you’re protected throughout your tenancy.

Proof of Income: Present a clear and comprehensive picture of your financial situation. You can provide bank statements, tax returns, and client contracts. Highlight the regularity and stability of your income.

Lease Agreement: Carefully review the lease agreement and understand its terms. Pay attention to the clauses regarding rent payments, late fees, and eviction policies.

Communication: Maintain open and transparent communication with your landlord. Promptly address any concerns and keep them updated on your freelance work. If you face any income fluctuations, inform them in advance.

Home Office: If you require a dedicated workspace, ensure your lease allows it. Some landlords may have specific requirements for home offices, so discuss it upfront.

Legal Advice: If you encounter any issues or feel your rights are being violated, seek legal advice from a tenant’s rights organization or a lawyer specializing in landlord-tenant matters.

By being proactive and knowledgeable about your rights, you can navigate the renting process as a freelancer with confidence. Remember, your income source doesn’t diminish your rights as a tenant.