Getting your apartment application denied can be a frustrating experience. It can feel discouraging, especially if you’ve been searching for a long time and have your heart set on a particular place. However, it’s important to remember that apartment application denials are not always the end of the road. There are a few things you can do to try and understand why you were denied and potentially improve your chances of getting approved in the future. This article will provide you with practical steps to take after receiving a denial, including understanding the reasons for denial, navigating the appeal process, and exploring alternative options.

Understanding the Reasons for Apartment Application Denial

It can be disheartening to have your apartment application denied, especially if you’ve been looking for a new place to live for a while. While it’s a frustrating experience, it’s important to understand the reasons behind the denial to learn from it and improve your chances of getting approved in the future. Here are some common reasons why apartment applications are denied:

Credit Score Issues: Landlords use credit scores to assess your financial responsibility and ability to pay rent on time. A low credit score can be a significant red flag, as it suggests a history of missed payments or financial instability.

Rental History: Landlords often check your rental history to see if you have a history of paying rent on time and taking good care of previous properties. Negative rental history, such as evictions or late payments, can make it difficult to secure an apartment.

Income Verification: Landlords require proof of income to ensure you can afford the monthly rent. Insufficient income or inconsistent employment history can lead to application rejection.

Background Check: Some landlords conduct background checks to verify your identity and criminal history. If there are any serious criminal offenses on your record, it could affect your chances of being approved.

Pet Restrictions: Many apartments have pet restrictions, including breed limitations or weight limits. If you have a pet that doesn’t meet the requirements, your application might be denied.

Application Errors: Mistakes on your application, such as incorrect information or missing documents, can also lead to denial. Be sure to carefully review your application before submitting it.

Understanding the reasons for apartment application denial can help you address the issues and improve your chances of approval in the future. By working on your credit score, building a positive rental history, and addressing any red flags, you can increase your chances of finding the perfect apartment.

Reviewing Your Application for Errors or Incompleteness

The first step after getting denied for an apartment is to review your application for any errors or incompleteness. There could be a simple mistake that can be easily corrected. Check for any typos, incorrect dates, or missing information. Make sure all fields are filled out accurately and completely. Even a small mistake can cause a denial, so it’s essential to be thorough.

Look for any missing documents or supporting materials. For example, if your application requires a pay stub, ensure you’ve included it. Also, check if you’ve provided all the necessary contact information, including phone numbers, email addresses, and emergency contacts.

Review your credit report. Landlords often check your credit score as part of the application process. If you have any errors or inaccuracies in your report, they could be contributing to your denial. Contact the credit bureaus to dispute any errors.

It’s crucial to be prepared and proactive. If you’re denied, don’t hesitate to reach out to the landlord or property manager. Express your interest in the apartment and ask for clarification on the reasons for the denial. This communication is crucial for getting a clear understanding of the issue and working towards a solution.

Contacting the Landlord or Rental Agency for Feedback

It’s normal to feel disappointed and even frustrated if your apartment application has been denied. While it’s a bummer, take a deep breath and try to understand why your application wasn’t accepted. One of the best things you can do to improve your chances for future applications is to reach out to the landlord or rental agency and ask for feedback. They may not be obligated to give you a reason, but if you’re polite and ask respectfully, they might be willing to share some insights.

When contacting them, be sure to thank them for their time and consideration, then ask about their decision. They may be able to tell you if there were specific issues with your application, such as a low credit score, a lack of rental history, or issues with your references. They may also share information about other requirements for their properties.

Understanding why your application was denied can help you to better prepare for future applications. It can also help you to address any potential issues that may have been preventing you from being approved.

Addressing Issues in Your Application

If your apartment application was denied, it’s important to understand why. The landlord is required to provide you with a reason in writing. This will help you address any issues and potentially resubmit your application. Carefully review the denial letter and understand the specific reasons given. Common reasons for denial include:

- Credit score: Your credit score may be too low for the landlord’s standards. If this is the case, you may need to improve your credit score before reapplying.

- Income: You may not meet the landlord’s income requirements. If you have a stable job, you can provide additional documentation, like pay stubs or a letter of employment, to prove your income.

- Rental history: If you have a history of late rent payments or evictions, the landlord may be hesitant to rent to you. You can provide a letter of explanation addressing any negative items on your rental history.

- Criminal background: If you have a criminal record, the landlord may be concerned about your suitability as a tenant. You may need to provide additional information or seek legal advice on how to address this concern.

Once you understand the reasons for denial, you can take steps to address them. If your credit score is the issue, work on improving it by paying your bills on time and reducing your debt. If your income is the concern, try to increase it or provide additional documentation proving your financial stability. By understanding the reasons for denial and taking proactive steps to address them, you can increase your chances of success in your next apartment application.

Improving Your Credit Score and Financial Standing

If your apartment application was denied, you may be wondering what you can do to improve your chances of getting approved in the future. One important factor that landlords consider is your credit score. If your credit score is low, it can indicate to landlords that you may not be a reliable tenant. Here are some ways you can improve your credit score and financial standing:

Check your credit report for errors. You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months. Review your reports carefully for any errors, such as incorrect account information or late payments that were not your fault. You can dispute any errors with the credit bureaus to get them corrected.

Pay your bills on time. This is one of the most important factors that affect your credit score. Even if you don’t have a lot of debt, paying your bills late can significantly damage your credit. Set up automatic payments or reminders to ensure that you never miss a payment deadline.

Reduce your credit card debt. High credit utilization (the percentage of your available credit you are using) can hurt your credit score. Pay down your debt as quickly as possible to improve your credit utilization ratio. You can also consider consolidating your debt into a lower-interest loan to make payments more manageable.

Don’t close old credit accounts. Closing old accounts can actually hurt your credit score, especially if those accounts have a long history of on-time payments. It can also lower your average credit age, which is a factor in your credit score.

Become an authorized user on a credit card with a good history. If you don’t have a long credit history or if you have a low credit score, you can become an authorized user on a credit card that has a good payment history. This will help to build your credit score and show that you are a responsible borrower.

Improving your credit score and financial standing takes time and effort, but it is well worth it. By taking steps to improve your credit score, you will improve your chances of getting approved for an apartment and other financial products in the future.

Seeking Help from Guarantors or Co-signers

If your apartment application has been denied due to credit history or income, you might consider asking a guarantor or co-signer to help. A guarantor or co-signer is someone who agrees to be financially responsible for your rent if you fail to pay.

Before approaching someone to be a guarantor or co-signer, make sure you have a clear understanding of your responsibilities and their obligations. You should also be transparent about your financial situation and the reasons why your application was denied.

It’s important to remember that asking someone to be a guarantor or co-signer is a significant request. It can impact their credit score and financial standing if you default on your rent.

Be prepared to provide them with all the necessary information, such as your lease agreement, credit report, and income documentation.

Exploring Alternative Rental Options

Getting your apartment application denied can be frustrating, but it’s important to remember that it doesn’t mean your search is over. There are many alternative rental options available, and you might be surprised at what you find.

Consider exploring these avenues:

- Roommate matching services: If you’re open to sharing living space, websites and apps like Roomster or SpareRoom can help you find roommates in a variety of locations and price ranges.

- Short-term rentals: Platforms like Airbnb or Vrbo offer short-term rentals for a few weeks or months, allowing you to explore different neighborhoods or find a temporary solution while you continue your search.

- House-sharing: Websites like HousingAnywhere connect individuals seeking rooms in shared homes, often with lower rent and the opportunity to build new friendships.

- Property managers: These companies manage multiple properties, offering a wider selection of apartments and potentially more flexibility in terms of application requirements.

- Direct landlord listings: Skip the middleman and connect directly with landlords by looking for listings on websites like Craigslist or Zillow.

Don’t be afraid to get creative! There are always new ways to find housing. Remember to thoroughly research any alternative options and be sure to read all the fine print before committing to a lease.

Learning from the Experience and Moving Forward

Getting your apartment application denied can be discouraging. It’s natural to feel frustrated, but it’s crucial to remember that rejection is not the end. There are valuable lessons to be learned from this experience, and using them to your advantage can improve your chances of success in the future.

First, try to understand why your application was denied. Contact the property manager or landlord and politely request feedback. They may be able to provide insights about your credit score, rental history, or income that could have contributed to the decision.

Second, take this opportunity to address any weaknesses in your application. If your credit score was a factor, work on improving it. If your rental history was an issue, try to build a positive one by being a reliable tenant in your current residence.

Finally, remember that there are many other apartments out there. Don’t be afraid to continue searching, and keep your application process streamlined. Utilize online resources, speak to real estate agents, and leverage your network.

Ultimately, getting your application denied is a chance to grow and learn. With the right perspective, you can use this experience to become a stronger and more successful renter.

Protecting Your Rights as an Applicant

Being denied an apartment application can be frustrating, but it’s important to remember that you have rights as an applicant. Landlords cannot discriminate against you based on your race, religion, national origin, family status, or disability. They also cannot deny you based on your source of income, such as receiving public assistance or having a co-signer.

If you believe you’ve been discriminated against, you can file a complaint with the Fair Housing Commission. You can also contact a lawyer who specializes in fair housing law.

In addition to discrimination, there are other reasons why your application may have been denied. You may not meet the landlord’s income requirements, have a poor credit score, or have a history of evictions. If you are denied for one of these reasons, you may be able to improve your chances of getting approved in the future by improving your credit score or increasing your income.

Remember, you have the right to ask for a written explanation from the landlord as to why your application was denied. This explanation can help you understand what you need to do to improve your chances of getting approved in the future.

Preventing Future Application Denials

Being denied an apartment application can be disheartening, but it’s an opportunity to learn and improve your chances for future applications. Here are some key points to remember:

Review the reasons for denial: Understand why your application was denied. Did you have a low credit score? Insufficient income? A negative rental history? This feedback is invaluable for taking steps to improve.

Address any issues: If your credit score was a factor, work towards improving it. If income was the issue, explore ways to increase your income or find roommates to share the rent. If you have a negative rental history, reach out to previous landlords to see if there are any outstanding issues you can resolve.

Consider your budget: Be realistic about your budget. Avoid applying for apartments that are beyond your means. Ensure you have sufficient savings for the security deposit, first month’s rent, and potential moving expenses.

Prepare a strong application: Ensure all your documentation is complete and accurate. Provide a detailed rental history, accurate income information, and references from past landlords. A thorough application demonstrates your responsibility and reliability.

Communicate effectively: Be proactive in communicating with the landlord or property manager. Ask for clarification on the denial reasons and express your willingness to address any concerns. A positive and respectful approach can make a difference.

Don’t give up: Keep applying and be persistent. Even if you’ve faced rejection, keep working on improving your credit, income, and rental history. With preparation and effort, you’ll increase your chances of finding a suitable apartment in the future.

Understanding Fair Housing Laws

It’s frustrating to have your apartment application denied. Before you start making other plans, it’s important to understand your rights under the Fair Housing Act. This law prohibits discrimination based on race, color, religion, national origin, sex, familial status, or disability in housing.

You have the right to live in a safe and welcoming environment free from discrimination. If you believe you were discriminated against, you have the right to take action. Here are some things to consider:

- Consider the reasons given for the denial. Were they legitimate? Did they sound discriminatory?

- Document everything. Keep track of the dates, times, and details of your interactions with the landlord or property manager.

- Consult with an attorney. A lawyer can help you understand your legal rights and options.

- File a complaint. You can file a complaint with the U.S. Department of Housing and Urban Development (HUD) or your local fair housing agency.

Remember, you are not alone. There are resources available to help you understand your rights and seek redress if you have been discriminated against. It’s important to stand up for your rights and fight for fair housing practices.

Appealing the Decision (If Applicable)

If your apartment application was denied, the landlord or property manager is required to provide you with a reason for the denial in writing. This reason should be a legitimate one, such as poor credit history, a history of evictions, or a lack of income verification. If you believe the reason for the denial is unjustified or unfair, you have the right to appeal the decision.

To appeal the decision, you will need to contact the landlord or property manager and request a review of the decision. You should provide them with any documentation that you believe supports your case, such as credit reports, pay stubs, or letters of recommendation.

The landlord or property manager is not obligated to overturn their decision, but it is worth appealing if you feel strongly that the denial was unfair. If your appeal is unsuccessful, you may want to consider seeking legal advice.

Finding Affordable Housing Options

If your apartment application has been denied, it can be frustrating and disheartening. However, it’s important to remember that you’re not alone and there are still options available to you. One of the first things you should do is look for affordable housing options.

There are many different types of affordable housing available, including:

- Government-assisted housing: This includes programs like Section 8, which provides rental assistance to low-income families.

- Non-profit housing: Many non-profit organizations offer affordable housing options to individuals and families.

- Shared housing: This can include roommates, house-sharing, or subletting. It’s a great way to cut down on living expenses.

- Rent-to-own programs: These programs allow you to rent a property with the option to purchase it at a later date.

To find affordable housing options, you can start by contacting your local housing authority, searching online resources like Craigslist or Zillow, or reaching out to non-profit organizations in your area.

Remember, finding affordable housing can take time and effort, but there are resources available to help you in your search. Be patient, persistent, and don’t be afraid to ask for help.

Negotiating with Landlords

If your apartment application was denied, don’t give up hope just yet! You may be able to negotiate with the landlord to get approved. Here are a few tips:

Understand why you were denied. The first step is to find out why your application was rejected. Was it due to your credit score, income, or rental history? Once you know the reason, you can start to address it.

Offer to improve your application. If your credit score is the issue, see if you can get a cosigner or offer to pay a larger security deposit. If your income is too low, offer to pay a higher rent or provide a letter of employment.

Be prepared to compromise. You may not be able to get everything you want, but be willing to negotiate and find a solution that works for both of you.

Be polite and professional. Remember that the landlord is still in control. Show them that you’re serious about getting the apartment and that you’re willing to work with them.

Be persistent. Don’t give up after one attempt. If the landlord says no, try again later. You may be able to convince them to change their mind.

Consider other options. If you can’t get approved for the apartment, consider other options. There are other landlords out there who may be willing to work with you.

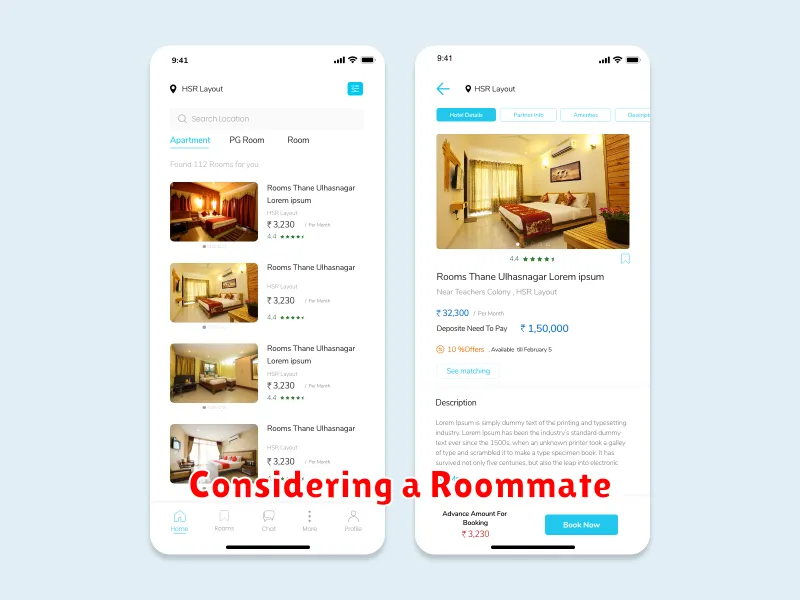

Considering a Roommate

If your apartment application has been denied, finding a roommate is one of the best ways to make an apartment more affordable. Even if you have the income to rent the apartment on your own, many landlords prefer to have two tenants, especially for larger apartments. Not only can it help you secure a lease, but having a roommate can also help you save money on rent and utilities.

Before you start looking for a roommate, consider your living preferences. Think about your lifestyle, habits, and budget. Do you need someone who is quiet and clean, or do you prefer a more social environment? How will you split the rent, utilities, and other expenses? It’s important to discuss these things with potential roommates before signing any lease agreements.

There are several resources available to find a roommate. You can use online roommate-finding websites, ask friends and family for recommendations, or even put up flyers in your local community.